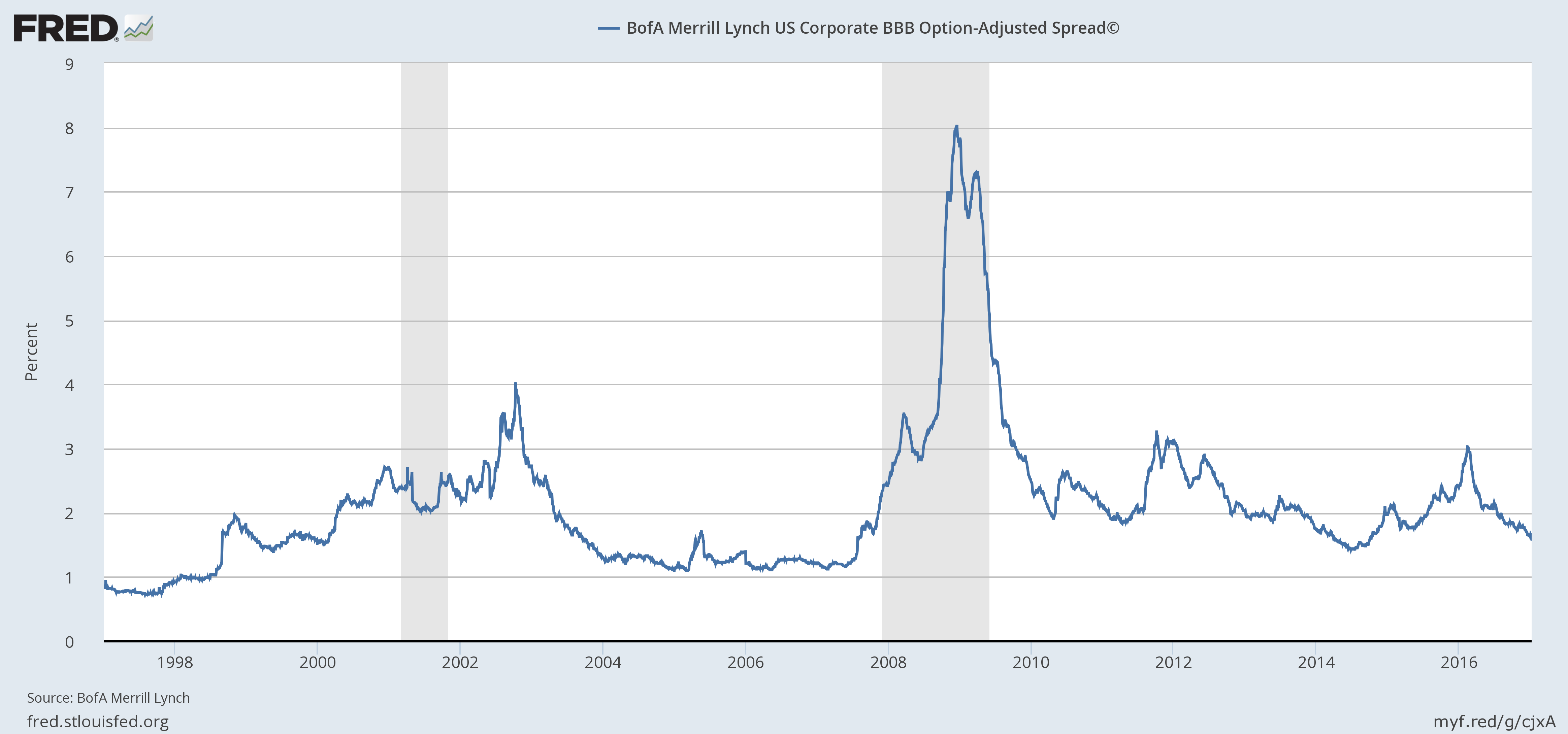

Investment markets are always characterised by uncertainty. An investor is rarely absolutely certain what return they will receive on their investment and in some cases if they will even see their capital returned. However, it’s probably fair to say that 2017 will likely be characterised by a greater than average level of uncertainty than what has been witnessed in the last few years. Here at Daintree Capital, we believe that 2017 will likely be a good time to be invested in low duration, credit assets. Interest rates are expected to move higher but credit spreads should perform reasonably well as corporate balance sheets are largely in good shape. As you can see from the chart below, credit spreads are only marginally below their long term averages.

The average BBB spread is currently 165 basis points versus a 210 basis points average over the last twenty years. We would largely expect investment grade credit spreads to be range bound in 2017 but with a chance of some small spread widening. With the ongoing monetary support provided by central banks and increased fiscal spending, we would expect default rates to remain relatively low. Given the absolute low level of cash yields and negative impact of a likely sell off in government bonds, short duration / floating rate credit exposures may prove to be a happy medium between those options. Taking on credit risk, rather than interest rate risk, certainly seems an appropriate position to take for the coming year.