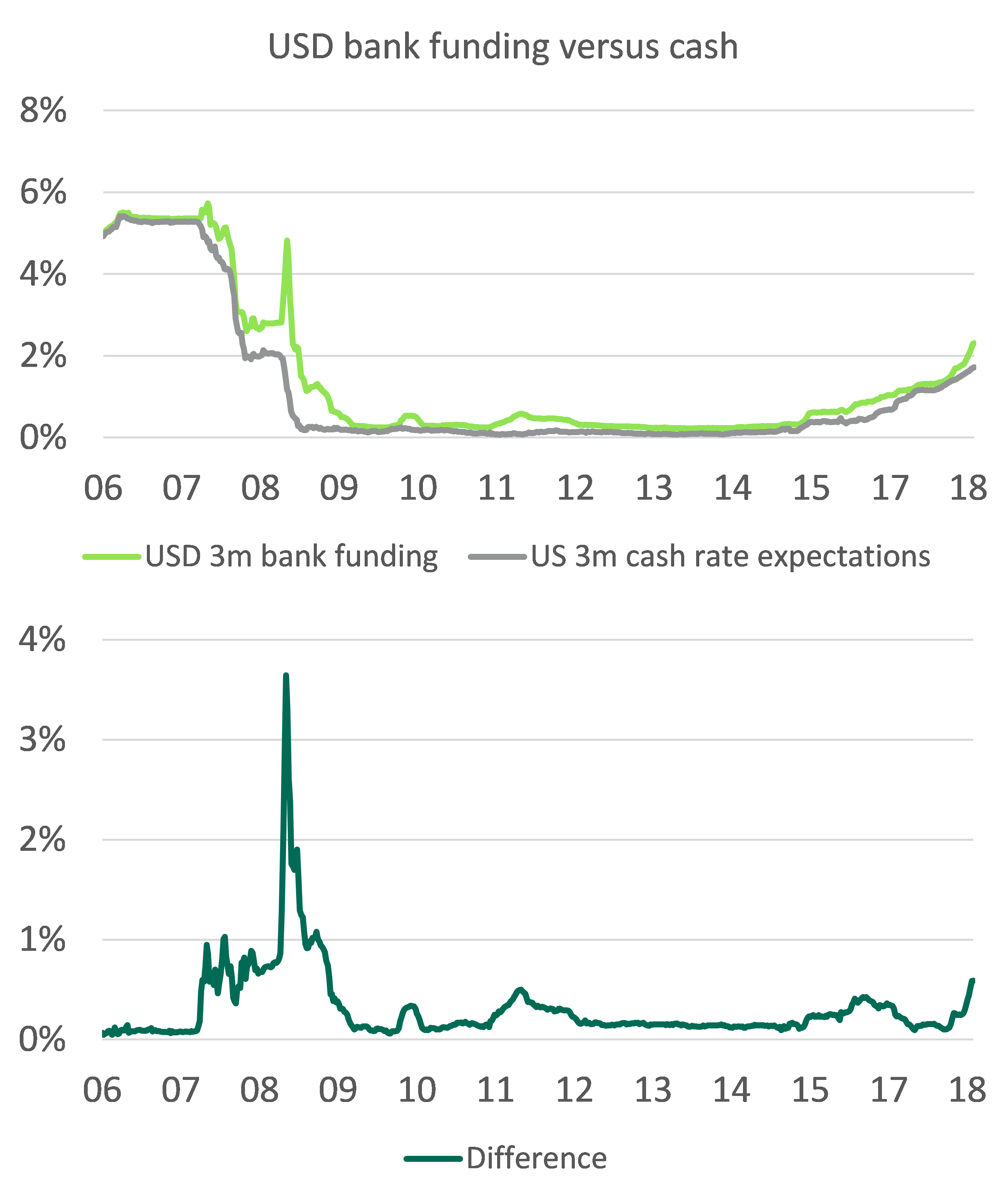

LIBOR stands for London Interbank Offered Rate. It is the rate that banks charge each other for short-term loans. It is typically close to the cash rate set by the relevant central bank. At times, (like now), it can price differently and in the past this has signified stress in the banking system. This time, we think the drivers are more benign.

Short term funding markets have attracted attention lately. These charts show why bank funding (LIBOR rates) became relatively expensive in 2007, signalling later problems. Here at Daintree Capital, we don’t think the current increase in LIBOR rates signals market stress though. Instead, we identify more benign drivers.

| AUD | USD |

Source: Daintree Capital; Bloomberg

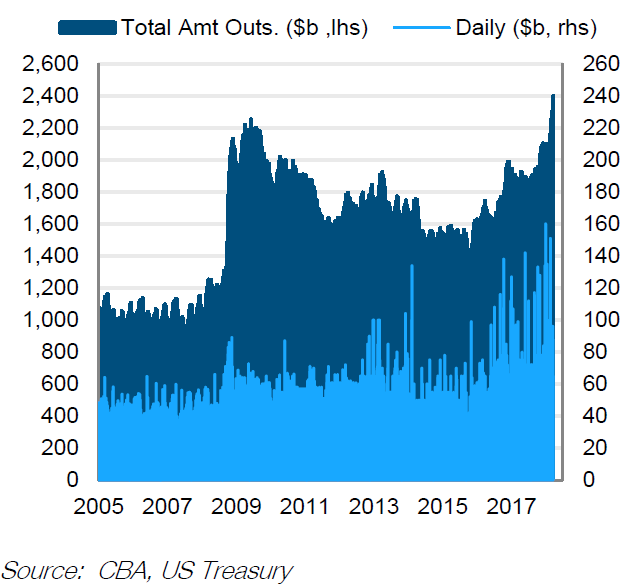

- US Government issuing shorted-dated fixed income: Tax reform makes it difficult for the US Treasury, the issuer of bonds on behalf of the Government, to predict the timing of tax receipts. This uncertainty will dissipate. Meanwhile, the US Treasury manages cashflow mismatches via increased short-term borrowings, called Treasury Bills.

Interestingly, the cost to the US of issuing Treasury Bills has not increased with supply. Costs to other borrowers have increased instead. We think this is an instance where public sector borrowing is crowding out private sector borrowers, because investors in short maturity debt prefer the relatively high credit quality of the US sovereign.

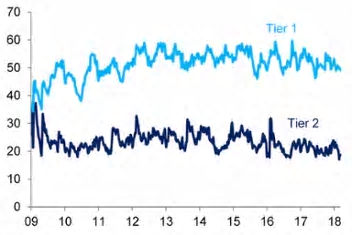

- Corporates buying shorter-dated fixed income: Tax reform incentives US corporates to spend profits held offshore in the US. If funds are to be spent, locking them up in financial assets makes little sense. Corporate treasurers have therefore reduced their investment horizon and commercial paper (the equivalent of Treasury Bills for corporate borrowers) issuance has increased, despite higher funding costs, to compete for this demand. The average maturity has decreased also (see charts below for evidence of this).

Commercial paper: Average days maturity and issuance volumes

Source: Citi

Both of these drivers push short-term private sector borrowing costs higher in the US. Australia (and in particular Australian banks) is a net borrower from the US, so these increased funding costs are also felt here. Credit availability to banks, corporates and individuals remains sound though, and central banks can slow monetary policy tightening to compensate for higher borrowing costs. Thus I don’t think funding stresses justify current market concern. Relative calm should return as the technical factors driving funding markets dissipate, and we may look to increase credit risk in the Daintree portfolios should current weakness continue.

This is the view of the author, Justin Tyler, Portfolio Manager.