Equity markets feel familiar to most investors, whilst fixed income markets tend to be less well understood. Perhaps one reason is that compared to buying an equity, it is extremely difficult for an individual to buy a bond. It’s not like you can head to a stock exchange and just buy a bond for yourself and pop it into your portfolio.

Equities are considered a growth asset, whereas fixed income products are generally more defensive, providing smaller, but much less volatile returns. However, fixed interest plays a very important role in an investor’s portfolio – one of insurance. The cash and fixed interest component of your portfolio plays a role to smooth out negative returns and to limit the falls in your portfolio’s value when equities markets go south.

(Take a look at the breakout box below for the amount of risk Australian retirees take when compared to their global counterparts.)

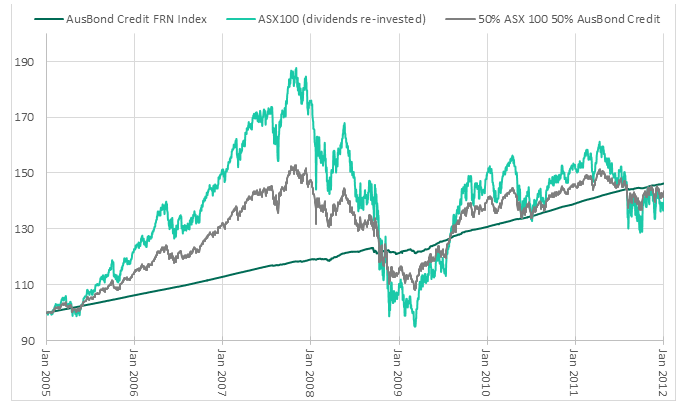

For simplicities sake: Let’s compare equity versus fixed income returns of a $100 investment from 2005 to 2012 to illustrate the defensive role fixed income can play in volatile periods, such as the GFC:

Past performance is not a reliable indicator of future performance.

Overall, the fixed income index achieved the highest total return, and with the least volatility. Furthermore, the mixed equities/fixed income portfolio generated a higher return than the pure equities portfolio but with approximately only half the volatility. This is a good example of how fixed interest can improve portfolio outcomes.

At Daintree Capital, we are very aware of the role that fixed interest plays in your investment portfolios and, given our absolute return style of investing, we aim to achieve a positive return across all market cycles. Our Core Income Fund is intended to be just that, the core part of your fixed income portfolio. You can find out more about the portfolio here.

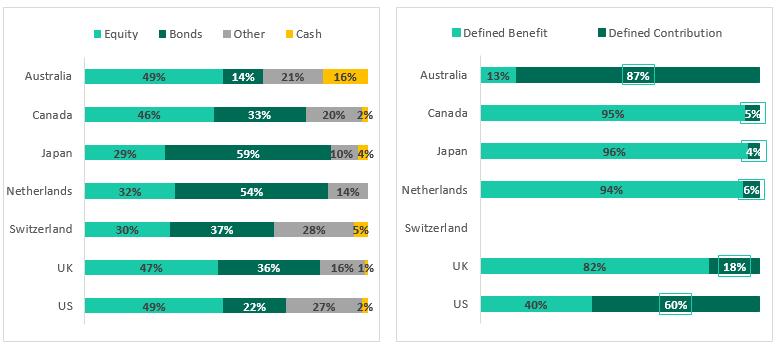

Global Retirement Fund Comparison

It is interesting to look at the composition of retirement funds in Australia compared to other countries.

Source: Willis Towers Watson

Not only does Australia have the joint highest equity and lowest bond allocation but Australia also has by far the largest defined contribution style split. (There are a number of reasons for this including our generous franking credit regime, although we are not addressing the reasons why here.) However we are pointing this out as it highlights that Australians are taking comparatively more risk than investors in other countries with their retirement savings.

This is the view of the author, Simon Lee, Senior Quantitative Analyst.