Whenever a new bond issuance comes to the market, one of the ways to determine an indicative range of spread is through looking at the existing curve for an issuer. If there is an existing curve, you can approximately solve for what the indicative spread for that maturity issuance should be.

In this post we will look at a prior transaction in the AUD domestic market where there was a relative value opportunity through the bonds available in the offshore market.

The issuer is Verizon who are the leading US wireless provider and the 2nd largest in the wireline segment in the US. It is the highest rated US telecommunications at Baa1 by Moody’s, BBB+ by S&P and A- by Fitch (for credit rating definitions and more information see our previous post here).

Verizon was a first time issuer in the Australian market in August 2017, where they issued 5.5 year, 7.5 year and 10 year maturity bonds. We will be looking at the 5.5 year issue where the spread was at 122bps over swap.

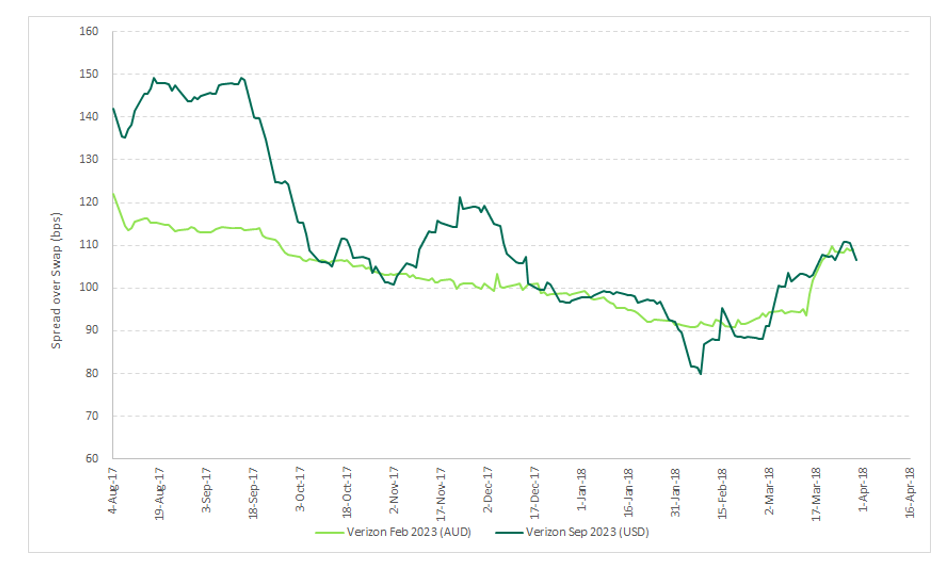

In the chart below, you can see that at the time of issuance, the AUD Verizon bond was priced at 122bps over swap. At the same time, the USD Verizon bond of similar maturity (7 months longer), was pricing at 20bps higher at 142bps over swap (converted back to AUD). We need to look out for differences in the bond documentation and terms. In this instance, apart from an upcoming tender for the USD bonds, the terms were quite similar. So by looking offshore, astute investors can pick up the same exposure to Verizon with a similar maturity for 20bps more.

Source: Daintree Capital

The chart shows that eventually the market corrected itself with the AUD and USD Verizon bonds now trading at a similar spread.

Being an absolute return manager, Daintree Capital is able to look offshore in various currencies to find relative value and capitalise on these opportunities. In this instance, we found that the Verizon USD bond of a similar tenor was giving a 20bps pickup compared to the first time issuer in AUD which would normally command a new issuer premium. This opportunity to take advantage of the relative value trade on the same issuer just by comparing the USD v AUD issuance, has created Daintree Capital investors 0.20% in added return. We are pleased with this result.

This is the view of the Author, Simon Wang, Senior Credit Analyst.