You may have heard in recent weeks that short-term interest rates are on the march higher. This has increased the cost of lending for many businesses, and the cost of funding for banks. But with banks wanting to maintain their profitability in an environment of rising costs and moderating loan demand, they are reducing interest rates on term deposits (TD).

Term deposit returns have been grinding lower since January 2011. Data collected by the RBA shows that the average “special” rate offered by all banks has fallen from 6.15% pa in December 2010 to only 2.25% in April 2018. For investors astute enough to lock in long-term arrangements years ago, they would now be particularly depressed at the miserly returns on offer to reinvest those funds.

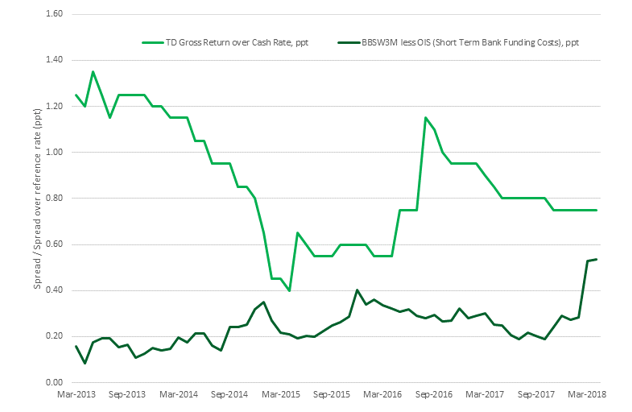

These trends are also playing out in returns relative to the cash rate. The chart below shows that the last time short-term funding costs rose (dark green line, albeit more gradually), the banks responded with a significant reduction in TD spread over the cash rate (light green line, but from a much higher starting point). The movement in funding costs this time round has been swifter and more pronounced, with little reaction as yet from banks with regard to TD pricing. We believe there is a risk of lower TD rates should these factors persist.

Source: Daintree Capital

There is a silver lining, however, for investors in floating rate bonds (like Daintree), because investors in this type of bond receive the same short-term interest rate that the banks or corporates are required to pay. Even better, floating rate bonds have very low duration, meaning this extra coupon income can be collected with little if any impact on the capital price of the bonds.

Daintree’s Core Income portfolio is ideally placed to benefit from current trends, with about two-thirds of its assets invested in floating rate instruments.

This is the opinion of the Author, Brad Dunn, Senior Credit Analyst.