Responsible investing is about much more than just evoking the common catchcry of Environmental, Social and Governance (ESG). Fixed income investors need to employ a more nuanced approach to get the most out of responsible investing. We will share a few strategies that we believe are suited to fixed income investment. First, we will define the analysis framework in a more intuitive way, and introduce the concept of materiality. We will investigate the challenges of engagement for fixed income investors and how these interactions can be leveraged most effectively. Finally, we will assess some of the practical ways that responsible investing can be implemented at the individual bond level, essentially letting the investment dollar do the talking.

(Re)-defining the framework

Every business, large or small, has a unique set of characteristics and challenges. Therefore, assessing a business through the lens of a rigid grouping of factors across three major domains will almost certainly lead to sub-optimal outcomes. So how do we balance our analytical approach given limited time and competing priorities?

We believe one answer could be to adjust the analysis framework. In other words, approaching each issue based on how much influence the business can have on the outcome (internal factors) and those elements which a business has to comply with, respond to, or is generally out of its control (external factors).

A good example of this approach is with coal miner New Hope Coal. Putting aside any philosophical objections to fossil fuels, the two photographs in Figure 1 were taken six years apart, and demonstrate the remarkable efforts the business has taken to remediate a former mine site well above standard requirements, to the point that there are now grazing operations active on the site, with significant reforestation also underway in keeping with the local environment.

The requirement to remediate the site was an external requirement imposed by the state government as part of the mining lease conditions. However the additional effort to bring the land back to grazing quality and other measures were an internal decision taken with the community and the environment in mind.

Figure 1: Mine site remediation – going above and beyond

Source: New Hope Coal Limited

The current situation at AMP is another case in point. Incoming chairman David Murray raised eyebrows recently when he outlined his plans to give more control of the operational performance to the CEO, allowing the board more time to consider broader strategic issues. This has put AMP on a collision course with the ASX and many corporate governance advocates who have spent years making corporate governance principles more prescriptive, and applied at board level. Obviously, it is important that the board retains a strong oversight power, but we tend to agree with David Murray in that strong businesses ultimately require strong leaders that are given sufficient scope and leeway to execute their vision.

The importance of materiality

While changing the analysis framework can help to improve our understanding of the business, undertaking a full review would be very time consuming. Therefore, we need a way to focus the analyst’s attention and ensure that the most important factors are pinpointed. One way to do this is to estimate the materiality of an ESG theme.

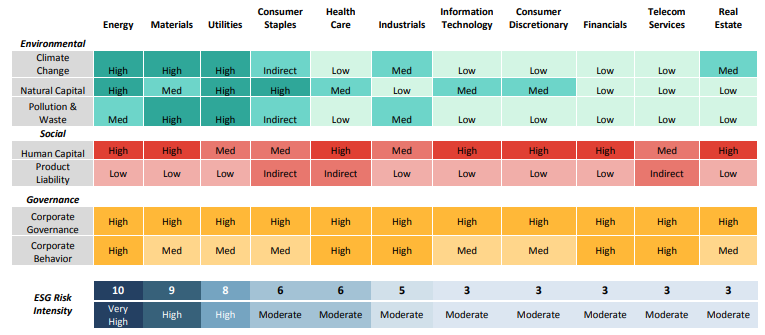

Materiality can be defined as the likelihood that a particular factor will influence the performance of a business, which could in turn have an impact on earnings, the environment, the community or its reputation. Materiality is ultimately subjective but researchers such as MSCI have made solid progress on estimating materiality at the sector level (see Figure 2).

Some of the risk assessments are self-evident, such as the materiality of climate change, pollution and the like for the mining, energy and utilities sectors compared to other sectors such as health care. However, despite the increasing shift to automation across many industries, MSCI identifies a Medium or High risk intensity to the management of human capital in all businesses.

Figure 2: MSCI ESG Risk Intensity

Source: MSCI

With the focus channelled on those areas where the risk intensity is high, it is more likely that any significant red flags with the potential to impact performance will originate from these areas. Once we have the full view of the potential risk identified, the focus can turn to pricing these risks as part of the investment process. In the New Hope case, track record in previous rehabilitations helps to address the Natural Capital and Pollution categories in Figure 2. In the AMP example, the Chairman’s proposed changes are related to the Governance factors and Human Capital, where risk intensity is estimated to be high.

The question of engagement

One way that investors can express their views when it comes to responsible capital allocation is through direct engagement with company boards and management. Fixed income investors find this much more difficult because they have a fundamentally different relationship with an issuer. Whereas equity investors have the board and management answerable to them as owners of equity in the business, fixed income investors have only a contractual relationship via their bond holdings.

This does not mean that fixed income investors should push ESG analysis into the dark corner of their desk. The reality is there are often indirect opportunities to engage with company boards and management, such as:

- when a new bond is offered,

- during result announcements (for publicly listed companies), and

- via interaction at industry conferences and events.

In each case, it allows specific ESG themes to be addressed in the public domain. While the company representative may be unable or unwilling to address the question in much detail at the time, simply asking the question will raise awareness in the broader market.

Practical incorporation of ESG in bond portfolios

While creating market awareness of ESG issues is important, it can be decidedly indirect. One way in which fixed income investors can take tangible steps to demonstrate a commitment to responsible investing is via specific purpose (otherwise known as “green”) bonds. These securities are structured to raise money with specific intentions built into the terms. Investors can influence the allocation of capital to environmental (such as by financing renewable energy projects, recycling facilities, sustainable timber plantations, etc) or social ends (such as through social impact projects and even gender equality programs). We see great potential in these bonds to facilitate real change, and Daintree Capital actively assesses new issuance when it is offered to market.

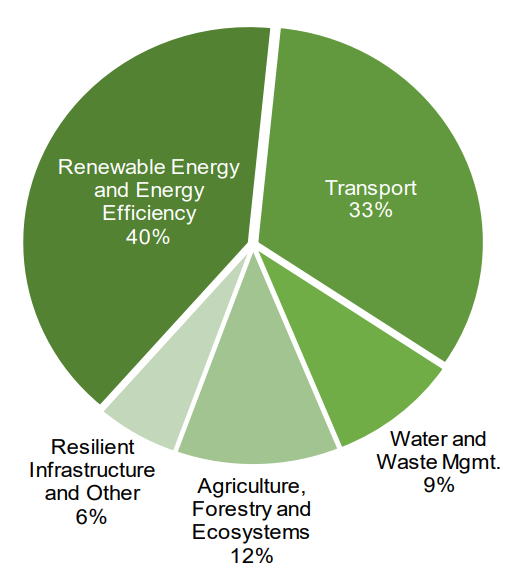

At the global level, the Climate Bonds Initiative estimates that in just the first six months of 2018 there was almost US$75bn of green bond issuance, representing 156 issuers from 31 countries. At the institutional level, entities such as the World Bank have been issuing green bonds for more than 10 years now, with more than US$23bn in committed, allocated or outstanding capital across several sectors (see Figure 3).

Figure 3: Sector allocation, World Bank green bonds

Source: World Bank

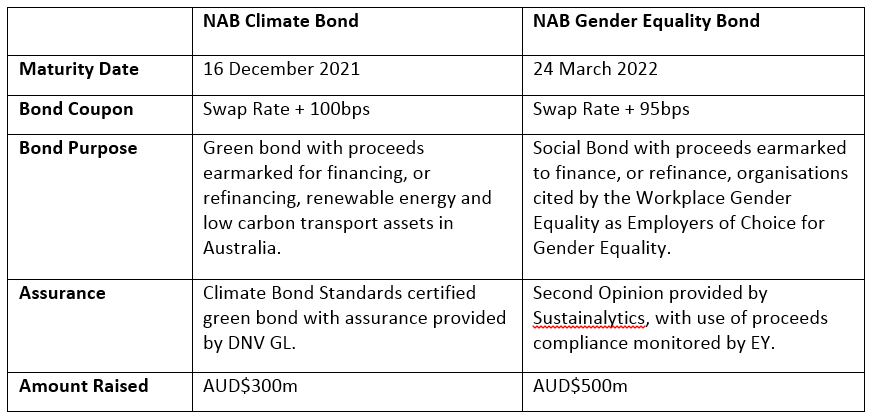

In Australia, financial institutions such as the National Australia Bank have taken a leading role in the development of a local green bond market. Many of the bonds are monitored by third parties to ensure compliance with bond terms, providing an extra layer of protection to investors. We see this independent oversight as an attractive feature to ensure that the bonds remain “true-to-label”. Two examples are included in Table 1.

Table 1: Green Bond details

Source: NAB

Conclusion

Responsible investing is not a one-size-fits-all proposition. We have suggested an approach that distinguishes between internal and external factors, ranked by materiality. Investors in fixed income need to make the most of their opportunities to engage with companies, knowing that increasingly their investment decisions at the individual bond level can reap tangible results. As the sector develops over time, we expect the range of analytical frameworks to grow, allowing smoother integration into investment processes. Ultimately, this will be to the benefit of local communities, the environment, and corporate governance.

Disclaimer: Please note that these are the views of the writer and not necessarily the views of Daintree. This promotional statement does not take into account your investment objectives, particular needs or financial situation.