Let’s lift the lid on fixed income investment jargon as we uncover the different types of fixed income securities.

We begin with traditional corporate bonds which are effectively a contractual obligation to pay – very similar to a loan. The issuer of a corporate bond is borrowing money, while the purchaser (investor) is providing capital for the company to use. Companies issue bonds for a variety of reasons including business expansion, acquisitions, and to fund share repurchases and dividends. Countries and States also issue bonds to fund infrastructure projects and services to the people. These are known as government bonds such as the 30 Year US Treasury.

In exchange for providing a loan, investors expect to be paid interest over the life of the investment and to have their original capital returned at maturity. The terms of the arrangement are agreed in advance. There are many conditions that must be agreed but two of the key ones are the length of the loan and the amount of interest to be paid. This can explain why it is called fixed income. The longer the term, the more interest borrowers have to pay. The riskier the borrower is perceived to be, the more interest they will have to pay.

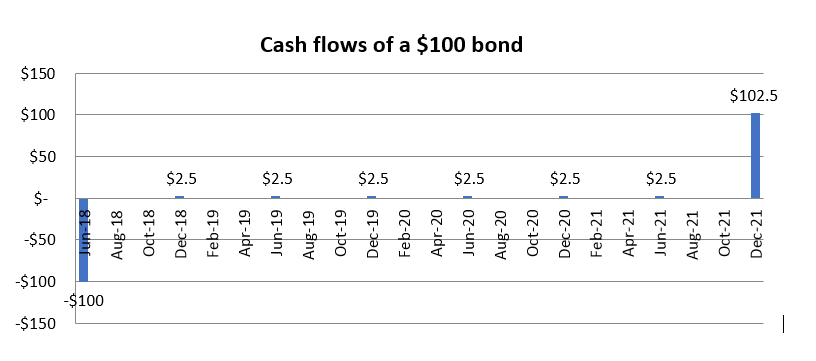

Below is an example of a typical cash flow for a bond. An investor provides the borrower $100 on day one. If we assume a 5% agreed rate of interest, the investor would expect to receive their interest throughout the year at regular intervals. In our example that is roughly 2.5% or $2.50 every six months. Then, at the end of the agreed period the investor receives their final $2.50 coupon, as well as the original $100 provided to the borrower.

Corporate bonds are widely held in fixed income portfolios both in Australia and overseas. They are generally much safer than equities (shares)as they provide a contractual obligation to pay income, unlike dividends which can be reduced or stopped at any time. A diversified portfolio of high quality bonds provides a regular, stable income stream, as well as materially better capital preservation (chance of getting your initial investment back) than seen in equity portfolios.

This is the opinion of the author, Mark Mitchell, Portfolio Manager & Director.