Defensive investing: why would you chose fixed income over gold?

In recent times, we have seen headlines from financial media discussing recession risk, geopolitical risk, trade wars, Brexit, late cycle stock market, leveraged loan implosion and yield curve inversion. These headlines have investors repositioning their portfolios defensively to minimise the impact that of a large drawdown from one of these risks. With all the recent market turmoil and event risk around the world, we have a look at using fixed income as a defensive asset compared to gold.

Gold

Gold is a defensive asset class and is generally considered to be a safe haven investment in times of economic or political uncertainty. On a historical basis, gold prices have not exhibited the same level of volatility as that of other asset classes such as oil, currencies or equities. The main shortcomings of gold are that it is a commodity and produces no income. Gold is traditionally seen as a hedge against inflation and to a certain extent, hedge against a stock market crash.

Warren Buffet critiques gold with the following quote “Gold, however, has two significant shortcomings, being neither of much use nor procreative. True, gold has some industrial and decorative utility, but the demand for these purposes is both limited and incapable of soaking up new production. Meanwhile, if you own one ounce of gold for an eternity, you will still own one ounce at its end.”

Fixed Income

Fixed income is a defensive asset class in nature and provides capital stability, income, liquidity and diversification compared to other growth-oriented asset classes such as equities and property.

Buying inflation-linked bonds is one of the ways to hedge against inflation like gold does. Inflation‑linked bonds (ILBs) are securities designed to help protect investors from inflation. Primarily issued by sovereign governments, such as the U.S. and Australia, ILBs are indexed to inflation so that the principal and interest payments rise and fall with the rate of inflation.

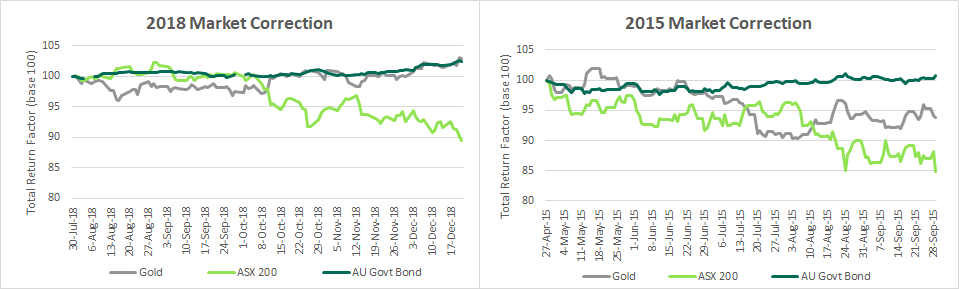

To hedge against a stock market crash, investors usually flock towards high quality government sovereign bonds. Australia’s sovereign rating is AAA, the highest quality rating assigned by the rating agencies. During stock market corrections, government bonds are heavily sought after and acts as a hedge against stock market drops.

If an investor still wanted exposure to gold, you could still do so through purchasing the bonds of gold mining companies which are exposed to the price of gold or to a lesser extent, mining service companies who help extract gold from the mines.

By investing in an unconstrained absolute return fixed income fund, there are numerous strategies active managers can utilise to position a portfolio defensively providing capital stability, diversification, liquidity all while still earning an income stream which you would not get with using gold.

Total Return Performance of Australian Government Bond Index, Gold and the ASX 200 Index over the last 2 corrections/

The author, Simon Wong, Senior Credit Analyst at Daintree Capital. Click on the links find out more about Daintree Capital’s Core Income fund and High Income fund.

Please note that these are the views of the author. This article is general in nature only and does not take into account your investment objectives, particular needs or financial situation.