Fixed Income products can often be characterised as a bit complicated and difficult to understand. One of the less straightforward securities available are residential mortgage backed securities (RMBS). This is a type of security that is backed by a collection of individual mortgages. The basic idea is that a company that issues these securities puts together a large group of mortgages (usually a few thousand of them) and puts them into a special issuing vehicle called a trust. The coupon and principal repayments of the securities are funded from the payments made by individuals as they make their mortgage payments and refinance their loans.

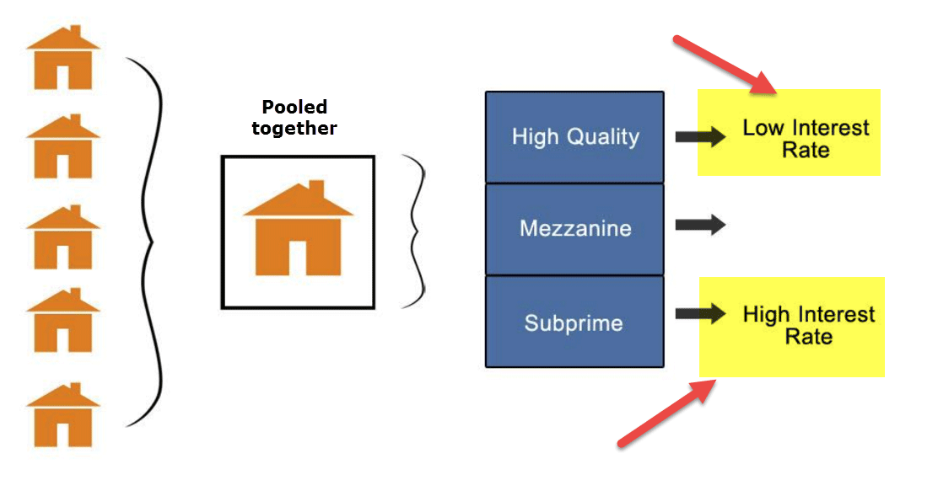

RMBS go through a process called “tranching” which essentially creates a priority of payment waterfall. The value of any type of investment is essentially a claim on future cash flows. RMBS are structured in such a way that there is a ranking of claims on those cash flows. This allows a collection of assets with similar risks to be grouped into low, medium and higher levels of risk to meet demands of different types of investors.

Source: Google Image

From an issuer’s perspective, selling these securities makes sense because it becomes another way for companies to fund their business in addition to traditional corporate bonds and equity. From an investor’s perspective, these types of securities offer good portfolio diversification, low volatility and a relatively attractive yield.

Its certainly worth considering including these types of assets in your portfolio, but the structures can be a bit complicated and difficult for an individual to fully understand all the risks they are taking. Therefore, it might make sense to invest in a diversified portfolio of the securities managed by experienced investors.

Disclaimer: Please note that these are the views of the writer and not necessarily the views of Daintree Capital. This article does not take into account your investment objectives, particular needs or financial situation.