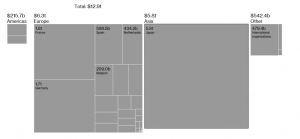

As the world moves to thousand-year interest rate lows, it might seem crazy that investors are still buying bonds with negative yields. Bond holders are paying for the privilege to lend money to bond issuers. Indeed, there are now $US13 trillion worth of bonds in the world yielding a negative return, mostly in Europe and Japan.

Source: Bloomberg

Einstein proposed that everything is relative, and this also is true for the bond investor!

An investor sitting in Australia can still receive a positive return for buying a negative yielding bond in Europe. How can this be?

The answer lies in hedging the currency risk and the difference between interest rates in Europe and Australia. If an Australian investor buys a Euro bond, it may well be wise to hedge the currency risk, otherwise any return on the bond could easily be blown away by changes in the exchange rate. This can be done by selling Euro and buying Australian Dollars at a future date, this is called a Currency Forward. Now my Australian portfolio holds the Euro bond virtually free of currency risk, but even better the Currency Forward will provide an addition return.

The reason for this is Covered Interest Rate Parity. Consider the following trades:

- Borrow money domestically

- Transfer the borrowed money to a foreign currency while using a Currency Forward to hedge the currency risk

- Earn interest on the foreign currency at the foreign risk-free rate.

- When the Currency Forward expires, use the proceeds to pay off the loan.

Theoretically, the investor has taken no risk and therefore the concept of no free lunch applies i.e. the total profit is zero. This means the price of a Currency Forward must take into account the difference between the domestic and foreign interest rates. The return on a Currency Forward must be the domestic minus the foreign interest rate. With Australian rates at about 1% and EUR rates at -0.4%, my Currency Forward earns a tidy +1.4%.

3-year Australian government bond currently yields about 0.65%, the corresponding German government bond yields -0.93%. However, with the currency hedge in place, the German bond, in Australian yield terms, jumps to 0.47%. Et voila! my negative yield is now a positive. Relativity holds even for bond investors.

The author, Simon Lee, is a Senior Credit Analyst at Daintree Capital. Click on the links find out more about Daintree Capital’s Core Income fund and High Income fund.

Disclaimer: Please note that these are the views of the writer and not necessarily the views of Daintree Capital. This article does not take into account your investment objectives, particular needs or financial situation.