With the increased volatility in the markets, investors and savers have gravitated towards term deposits as their haven of safety and liquid cash. The rates in term deposits look attractive compared to the current cash rate of 1% in Australia but life is full of unexpected events and there are times when you will need to withdraw funds before the term deposit matures when you experience a cashflow problem or some other financial emergency. We look at the penalties imposed for withdrawing your term deposit before your maturity term is up and compare that to investing in a fixed income fund which offers the same daily liquidity, diversification and higher returns without the harsh penalties of a term deposit.

The two main penalties for withdrawing a term deposit early are the need for a 31 day advance notice to the bank and the prepayment interest adjustment to your interest rate, which is typically based on how long a term you have left till the maturity of the term deposit. You also incur an administration fee. So, if you are in need of your funds urgently from your term deposit, you essentially have your liquidity locked up for 31 days and also incur an adjustment to your interest rate and an administration fee, depending on which financial institution you have your term deposit with. While some financial institutions may not have the 31 day lock up, they all have a similar prepayment interest adjustment applied. It is also worth noting that minimum balance limits often apply to term deposits. So even if you are only withdrawing a partial amount, if this reduces your account balance below the minimum limit, your account could be automatically closed and the interest rate reduction could apply to the entire balance.

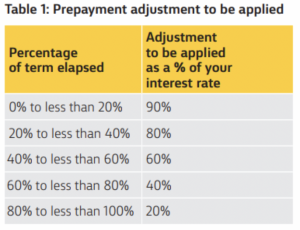

We will have a look at the impact on your supposed interest earnings based on if you needed to pull out your funds before maturity for a term deposit compared to investing in a fixed income fund. We will use the simplified example of CBA’s prepayment adjustment to interest rates shown in the table below.

Source: CBA Term Deposit General Information and Terms and Conditions

Source: CBA Term Deposit General Information and Terms and Conditions

As an example, if your funds are invested for half of the agreed term (6 months out of a 1 year term deposit), the prepayment adjustment to be applied will be 60%. Based on the current agreed interest rate when you opened the term deposit was 2% p.a., the interest rate you will earn on the amount that you have withdrawn early will be 40% of the interest rate agreed at the start of the term, in this case 0.8% p.a. (that interest rate is lower than the current RBA cash rate). Let’s assume you have $100,000 invested in a 12-month term deposit and you wish to withdraw the entire amount:

If you waited until maturity, you would earn $2,000 interest. However, if you withdrew funds halfway (6 months) into the term, you would be penalised with the rate adjustment and a $30 administration fee, earning only $770 interest. This would also only be if you notified the bank 31 days in advance before being able to pull your money out. There is no legal requirement for the financial institution to break your term deposit early, even if you request for this to happen.

With a fixed income fund like Daintree Capital’s Core Income Trust, you will be diversified across 100 issuers including the major banks and high quality corporates, while having daily liquidity (no 31 day advance notice period) and a buy/sell spread of 5bps (0.05%) to enter and exit the fund. The fund in the July quarter had a one year 4.18% performance (net of fees) whereas the CBA 1 Year Term Deposit rate advertised is 1.55%. The fund is also unconstrained so you will benefit with a stable investment during times of market volatility while also participating in increase of returns in the event that interest rates do rise as opposed to being locked in at the current rates for a term deposit. So while term deposits are generally consider a safe investment, that perceived safety generally comes at the cost of low returns, poor liquidity and severe penalties for early withdrawal. There are better options available.

Disclaimer: Please note that these are the views of the writer and not necessarily the views of Daintree Capital. This article does not take into account your investment objectives, particular needs or financial situation.