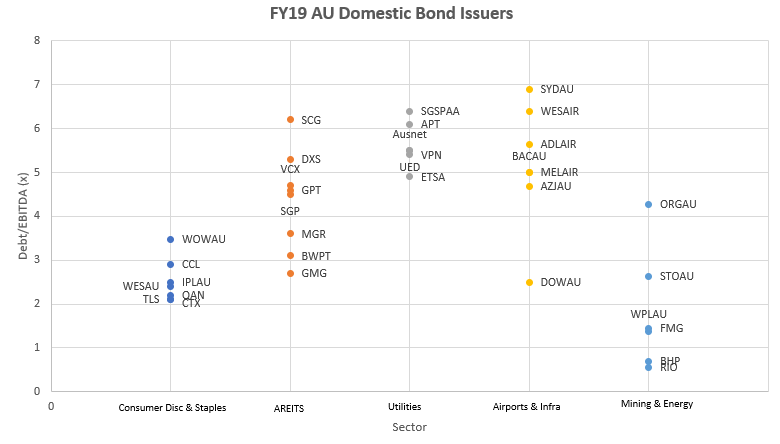

With FY19 having passed and the next quarterly updates in progress, we look at the major themes of the different sectors of corporate credit issuers in the Australian domestic market. The Bloomberg Ausbond Credit 0+ Year Index is the benchmark for Australian corporate issuers with 387 constituents at a spread duration of approximately 3.7 years, average life of 4.15 years and average credit quality of A+. The index is primarily made up of the government sector accounting for 19.2% of the index and financials accounting for 41.7%. The remainder 39.1% is split between the corporate issuers.

The state of domestic corporate credit market is still very tight with limited supply and the demand in issuance has seen large oversubscription for any issuance. Credit quality over the financial year has not deteriorated and most businesses are preferring to not pursue any large capex projects in an environment of volatile global headwinds, leading to strengthened balance sheets and increased shareholder returns.

The Australian Real Estate Investment Trusts (AREITS) have increasingly raised equity or engaged in third party capital partnering to fund growth ambitions and prevent increases to gearing. Office and Logistics continue to see strong underlying performance while retail shopping centres remain subjected to structural and cyclical pressures, resulting in wider capitalisation rates on recent divestments. The residential sector faced pressures with consumer weakness, house price declines and limited credit impacting demand, though the market seems to have bottomed.

The regulated utilities continue to experience tougher determinations from the regulators in the form of lower rate of return assumptions driving lower revenues, capex and opex. Airports saw a softening in passenger numbers where a slowdown in global growth and China saw lower international passenger growth in tandem with subdued domestic travel. The toll roads saw moderate growth in toll traffic offsetting the impact of fee reduction while the ports saw softened growth with imports impacted by the downturn in the property sector and exports impacted by the drought. There was also a higher throughput of empty containers which weighed on margins. Aurizon saw lower revenues reflecting the impact of UT5 Final Determination as well as lower volumes in Bulk and impact of the Queensland floods. Aurizon also announced the restructuring separating its above and below rail businesses. The bonds issued in the market are issued from the regulated below-rail business entity.

Consumer Discretionary & Staples issuers are facing similar headwinds experienced by the retail AREITS, with subdued growth due to fewer consumers drinking soft drinks and alcohol, while competitive supply from Europe kept milk prices low. The supermarkets maintained like-for-like store growth with the impact of the drought seeing less price deflation and increased focus on promotional activity to retain market share.

The telecommunication providers continued to experience strong competition in the wireless space with promotional activity and churn rates continuing to impact on margins. Fixed line revenues and network applications and services continue to face strong competitive pricing pressures.

In the materials & energy sector, BHP reported strong earnings and profits with the US shale divestment resulting in record shareholder distribution but little impact on credit metrics along with stable margins and leverage. Caltex reported weak profit and earnings growth impacted by weak refinery results and with the new CEO announcing the divesture of 50 retail sites and cost cuttings, marking a change in strategy under the prior CEO. APA Group delivered strong revenue and earnings growth with a strong balance sheet to fund offshore acquisitions while retaining current ratings, looking for opportunities in North American gas infrastructure assets.

Source: Moody & S&P

Disclaimer: Please note that these are the views of the writer and not necessarily the views of Daintree Capital. This article does not take into account your investment objectives, particular needs or financial situation.