As we enter a new year, financial markets are displaying tangible signs of optimism. Equity markets are setting new record highs, credit spreads are at their lowest levels in two years, and according to JP Morgan even volatility in the foreign exchange markets has dropped to record lows. While the list of negative catalysts has arguably shortened, investors are feeling confident enough to put capital to work as we embark into a new decade.

Figure 1: Volatility of foreign exchange markets

Source: Bloomberg, JPMorgan

A good example of the prevailing mood was a recent issue of bank hybrid capital by global wealth manager and investment bank Credit Suisse. It offered US$1bn at an indicative yield of 5.75% and a 10-year first call date. Because demand peaked at an eye-watering US$20bn, investors were willing to accept a yield of 5.10% to secure an allocation. For an AUD investor, the hedged yield would approximate to about 4.60%. Furthermore, issuance of investment grade bonds is about 20% higher than over the same period last year.

What happened to all the risks?

Despite the broadly upbeat environment, risks have abated but certainly not disappeared. Uncertainties have reduced around Brexit, a “phase-one” trade deal has created some breathing space between the US and China, and even relations between the US and Iran remain strained but stable for now.

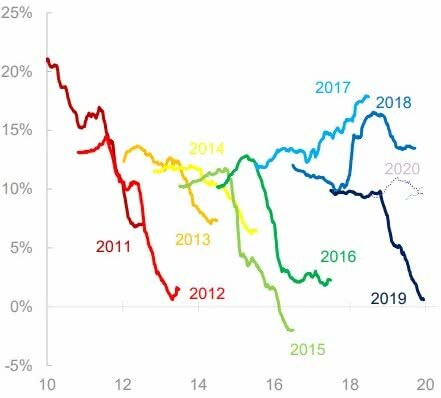

One factor we have considered closely in recent weeks is the continued dislocation between market performance and company earnings. Weaker corporate earnings have implications for both equity and credit markets. While current consensus expectations are for earnings growth in the high single digits this year, recent experience has shown analysts progressively tapering expectations as the year unfolds, with notable exceptions in 2017 and 2018 due to US corporate tax cuts.

Figure 2: Consensus global EPS growth projections, by year

Source: Citigroup

While we are hopeful that GDP growth, corporate earnings and equity and credit markets can improve this year, we are reminded of the self-evident observation by former chairman of the US Council of Economic Advisers, Herbert Stein: “If something cannot go on forever, it will stop”.

Conclusion

Central banks are working to keep financial conditions accommodative with lower-for-longer interest rates and ample liquidity, which supports our current portfolio stance and our outlook for credit markets this year. In the absence of a major unforeseen geopolitical or market event, the search for sustainable yield will continue. That said, we remain alert to signs that simple economic reality could trip-up the market juggernaut as 2020 progresses.

Disclaimer: Please note that these are the views of the writer and not necessarily the views of Daintree Capital. This article does not take into account your investment objectives, particular needs or financial situation.