Key Points:

- Banks have found themselves at the centre of the response to COVID-19, acting as valuable shock absorbers to the real economy.

- A range of measures have been implemented to assist in this task, but the full extent of the damage will not be known for some time.

- Financial markets have remained open for many corporates, helping to share the burden with the banking system.

- Dividend payments have been curtailed as banks retain capital. We expect this to continue until there is more clarity around the default profile.

- A delicate balance must be found between supporting borrowers and managing capital and liquidity positions once the support measures are withdrawn.

- Overall, large global banks in Daintree portfolios are well placed to help chart a path to recovery.

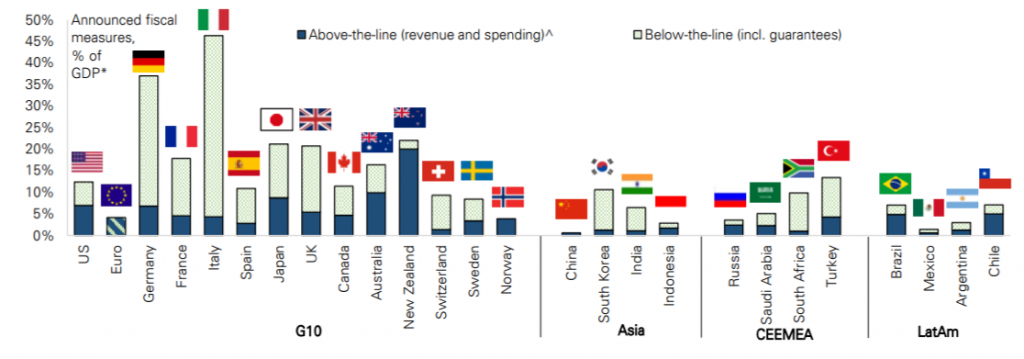

The banking sector is at the forefront of the global response to COVID-19. Large banks have been instrumental in offering access to credit for corporations with existing but undrawn facilities. Other support measures include offering repayment holidays to those most affected by restrictions, facilitating market transactions to allow corporations to issue bonds in public markets where possible, and working closely with governments to implement other support measures. Indeed, Deutsche Bank estimates that some countries have put in place support equivalent to 45% of their national GDP (see Figure 1), and that is just the fiscal component, not to mention the actions of central banks on the monetary front.

Figure 1: Total fiscal support announced during 2020

Source: Deutsche Bank, national data.

The support measures are certainly not a panacea. There are undoubtedly more difficult times ahead even as the recovery gathers pace. Despite being at the coalface, large global banks entered this crisis in excellent health. After the ravages of the GFC, where banks were the centre of attention for entirely different reasons, significant steps have been taken to strengthen and fortify banks from the inherent cyclicality of their business. All that work is coming to fruition as they negotiate this once-in-a-generation event. Each country has formulated its own approach, but at a high level the responses for banks specifically have included a mixture of debt guarantees, regulatory relief (essentially exempting loans that were subject to forbearance from being classed as non-performing), allowing flexibility in some capital ratios, and access to subsidised funding to ensure the flow of credit continues.

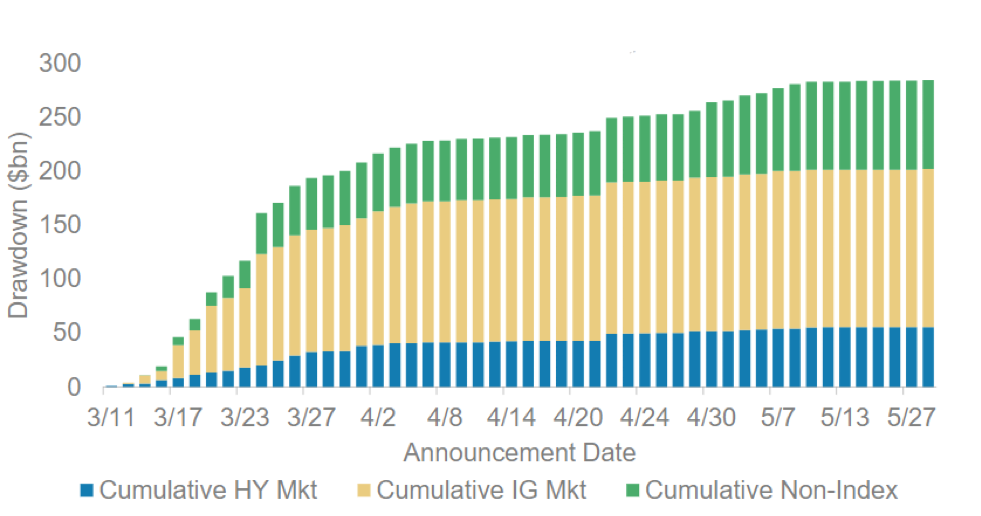

In the early days of the pandemic, corporate borrowers moved swiftly to draw down on unused lending facilities to shore up their liquidity. This placed some stress on capital ratios because the drawdowns happened so quickly, but the drawn funds largely ended up being re-deposited with the lending bank or within the same banking system, alleviating liquidity concerns for the banks themselves. Weak liquidity in the banking system was one of the major drivers of the GFC.

Figure 2: Cumulative drawdown of revolving facilities (USD)

Source: Company data, FactSet, Morgan Stanley

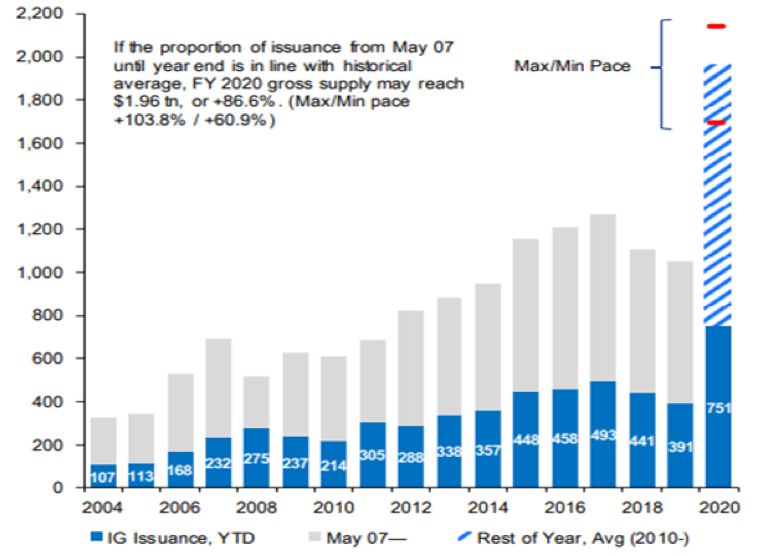

Another supporting factor was the astonishing appetite for new debt issuance from capital markets. After the US Federal Reserve announced the unprecedented move to support primary and secondary credit markets, investors began wholeheartedly buying corporate bonds to the extent that primary issuance is now running well ahead of the same period last year, but secondary market spreads have almost fully recovered to levels observed pre-COVID.

Figure 3: Issuance trends, US Investment Grade

Source: Citigroup

Banking health check – back to basics

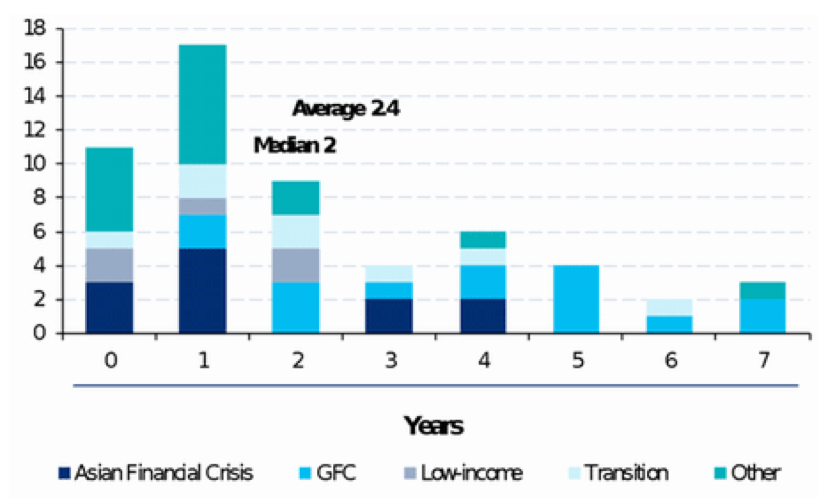

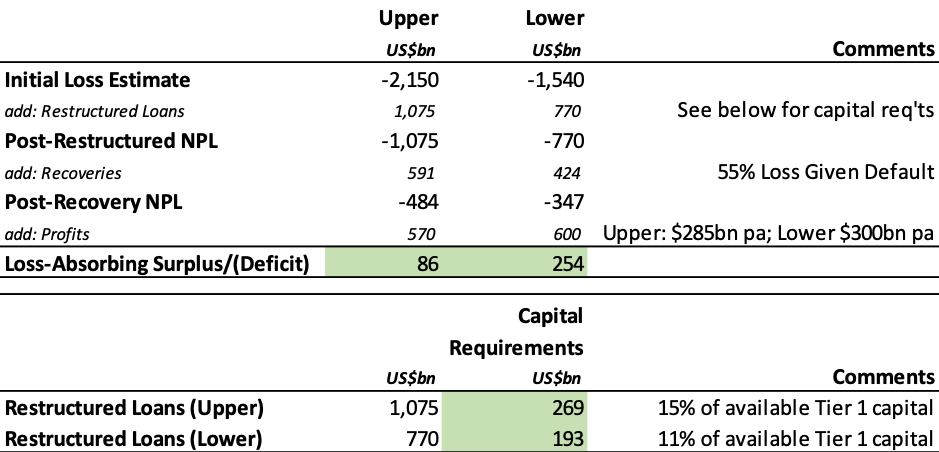

The scale of the challenge facing the banks is vast. At the end of 2019, banks in Daintree portfolios held approximately USD$30.7tn in assets. Best estimates of the proportion of these assets that are subject to some form of forbearance range between 5-7%, or USD$1.54-2.15tn. According to the IMF, it will likely be more than two years before the full extent of the losses are known.

Figure 4: Time to the peak of NPL losses since 1990

Source: IMF

We believe that in aggregate, global banks are in a strong position to manage the challenges ahead. Lenders will take a systematic approach to managing risks, which in the first instance will include seeking to restructure loans where they identify a strong chance that the borrower will remain viable as conditions normalise. In this regard, governments can assist by offering their balance sheet in the form of guarantees and/or subsidised funding for the banks, such as has been implemented by the Reserve Bank of Australia. Restructurings require banks to allocate additional capital to these new loans, which is infinitely more valuable use of this capital than allowing to absorb actual losses. Importantly, banks have placed at the centre of the recovery as it will be their own credit assessment policies that decide which borrowers are offered restructurings. In other words, they will have significant influence over who survives and who defaults. This will no doubt make them the target of anger and scrutiny, but the decisions will be vital to help the global economy recover in the years to come.

Where a restructuring is not possible, banks will then seek to enforce any security claims they have over the borrower’s assets as part of the loan contract. For a residential borrower this is usually the house, but for corporate borrowers it can be any number of different asset types. Enforcement of security rarely recoup all funds owed to the lender. Data from research house Moody’s shows that average recovery rates for secured bank loans are approximately 70%, far higher than unsecured bonds which average about 43% recovery.

Figure 5: Annual loan and bond recovery rates, 1990-2019

Source: Moody’s

Any losses not recoverable from security are funded from loss provisions, or if these are insufficient, the current period profit. On a pre-tax, pre-provisions basis, Daintree portfolio banks reported profits of approximately USD$325bn in the 12 months to March 2020. To help make these profits available to absorb losses, most large banks have either had temporary restrictions imposed or have independently cancelled or deferred dividend payments and share buybacks. Equity investors should be prepared for reduced payouts from banks for the foreseeable future. Reduced dividend payouts create challenges for income investors, but we view them as an essential part of the response to ensure the longer-term viability of the banking system and the smooth functioning of national economies.

Conclusion

Taking all measures into account, the global banking system stands well prepared to address the myriad issues arising from COVID-19. A sector-wide approach highlights the broad sequence of events likely in coming years, but individual banks will fare better than others. The measures taken to improve the resilience of the industry are proving their value by ensuring capital is available to facilitate restructurings, absorb losses and allow banks to calmly and methodically work through their exposures. The health and viability of the banking system is paramount as we chart a path to recovery, but we expect bank equity holders to endure dividend cancellations or reductions for some time to come.

Table 1: Assessment of Loss Absorption, Daintree Portfolio Banks

Source: Bloomberg, Company data, Daintree estimates; NPL = Non-Performing Loans.

Disclaimer: Please note that these are the views of the writer and not necessarily the views of Daintree Capital. This article does not take into account your investment objectives, particular needs or financial situation.