The Inside Adviser – Ishan Dan

Daintree Capital Core Income Trust

Daintree Capital is an ultra-modern, specialist absolute return funds management boutique with a primary focus on protecting client capital against downside risk.

How are Daintree innovating?

Daintree have developed an innovative short duration, active fixed income strategy that manages risk in a ‘lower for longer’ or rising interest rate environment. Daintree Capital says, “the world has changed for fixed income investors and they are facing a tough decision: continue to invest as usual or accept the new normal and learn to navigate a changed landscape”. Opting with the latter, Portfolio Managers Mark Mitchell and Justin Tyler use their expertise in an effort to deliver returns of 1.5% to 2.0% through the cycle. Portfolios include both investment and sub-investment grade bonds, along with senior and subordinated bank and industrial company debt.

What is the approach?

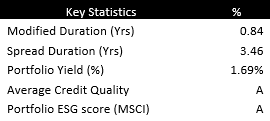

Having realised that an environment of exceptionally low government bond yields or in some cases negative real interest rates was likely to be the new norm for years to come, Daintree Capital sought a way to achieve an acceptable level of both risk and return. The strategy is to structure the portfolio with short duration credit and fixed income securities and cash, which provides a total return (after fees) that exceeds the RBA Cash Rate by 1.50-2.00% p.a. These are generally floating rate, with these coupons the largest contributors to performance since inception.

It achieves this by investing in a ‘high quality’ portfolio of fixed income securities, with an expected average credit quality rating of A or better. “Daintree also screens out coal and energy extraction companies on environmental grounds, among other exclusions such as tobacco, controversial weapons, and, for New Zealand-based clients, whale meat and cannabis.

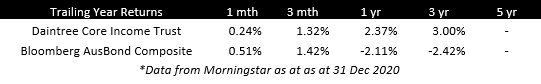

Characteristics & Performance

The fund has been strong in 2020, with tighter credit spreads the main driver of returns. This was particularly the case in October and November following the vaccine news, with spread compression slowing in December.

According to Daintree Capital “there are two ways to reduce risk in a portfolio. One is to dilute it (by decreasing risk asset exposures in favour of lower beta assets or cash) and the other is to seek to actively reduce it, by seeking a low or negatively correlated exposure.” However, trying to find bonds that are negatively correlated to equity markets can be problematic as government bonds have become more positively correlated with equities. With bond investing, it’s all about avoiding losers, not picking winners as the capital upside is constrained.

Disclaimer: Please note that these are the views of the writer and not necessarily the views of Daintree Capital. This article does not take into account your investment objectives, particular needs or financial situation.