“Buy when the cannons are firing, sell when the trumpets are blowing” – Nathan Meyer Rothschild

Over the last 40 years, geopolitical events seen through a financial lens have generated only brief interludes of volatility as the risk was discounted into asset prices, followed by a relatively swift recovery. History can tell us how economies or the markets reacted when faced with war or inflation in the past – and while informative, history rarely repeats but it often rhymes. In response to considerable uncertainty, we have shifted to a more defensive stance, with more risk mitigation in place than we have ever had.

We continue to work through all the implications, as it pertains to credit, of the Russia/Ukraine conflict and the outlook for inflation. There are many factors to consider.

Impact on economic fundamentals

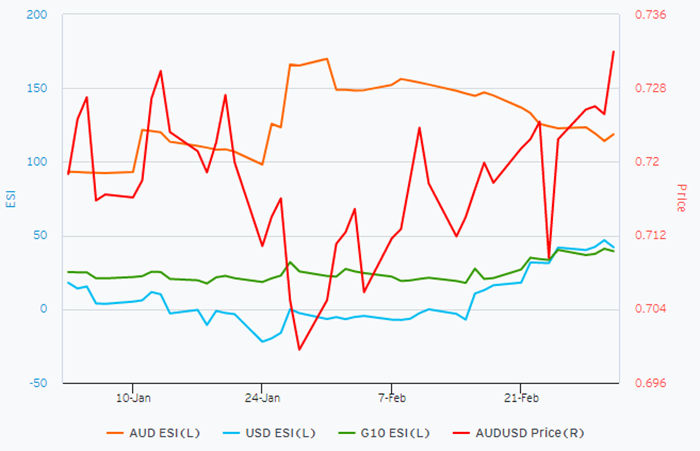

Up until the beginning of kinetic warfare in Ukraine in late February, the global economy was well into a recovery. Demand for commodities and finished goods was robust, even as pandemic-related disruptions persisted in shipping and supply chains. But as Figure 1 shows, Australia’s economic performance has been “surprising” forecasters to the upside in 2022. We think that Australia’s position as a trusted energy exporter is key to this optimism, supporting the currency. Economic surprise indices (at least prior to the war) for the G10 had also been improving and were well into positive territory.

Figure 1: Citi Economic Surprise Indices

Source: Citi. Data as at 4 March 2022.

A protracted war in Europe is itself a risk to the growth outlook, particularly on the continent, but the impacts of a war on inflation more broadly adds another dimension to the prospects for economic activity in the near term. As we have seen in recent weeks, war is inherently inflationary, especially when the principal participants are large exporters of raw materials ranging from wheat to energy.

Monetary policy implications

Prior to the start of hostilities in Europe, the topics du jour were tapering, quantitative tightening and interest rate normalisation. Indeed, central banks in the UK, Canada and New Zealand have all increased interest rates to address strong inflationary forces.

Central banks are in a tough spot, especially the Federal Reserve, that will react to an annualised inflation print running at more than three-times its target. A well telegraphed move of 25bp in March will herald several similar moves during 2022. However, we believe that the introduction of geopolitical instability has the potential to challenge the perceived “inevitability” narrative.

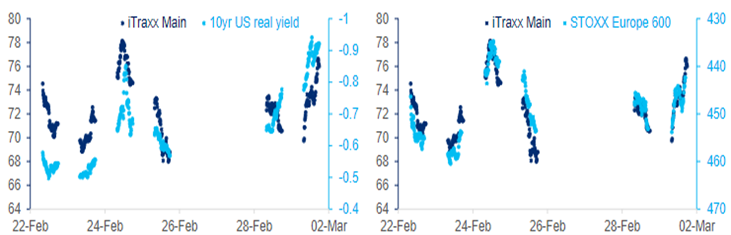

Real yields (ie: bond yields that are adjusted for the impact of inflation) are falling again as investors seek protection from conflict-related instability in safe-haven assets such as Treasuries. Usually, this would be positive for risk assets such as credit spreads and equities. But as Figure 2 shows, in recent weeks this relationship hasn’t just broken down, it has reversed. The flight to safety impulse is outweighing the interest rate normalisation narrative.

Figure 2: Credit index correlations

Source: Citi, Bloomberg

Challenges in money markets arising from sanctions

Much of the world has imposed harsh economic sanctions on Russia, including the expulsion of the Bank of Russia and several commercial banks from the largest global payments system, SWIFT. As a result, we suspected that this could cause disturbances across the financial system.

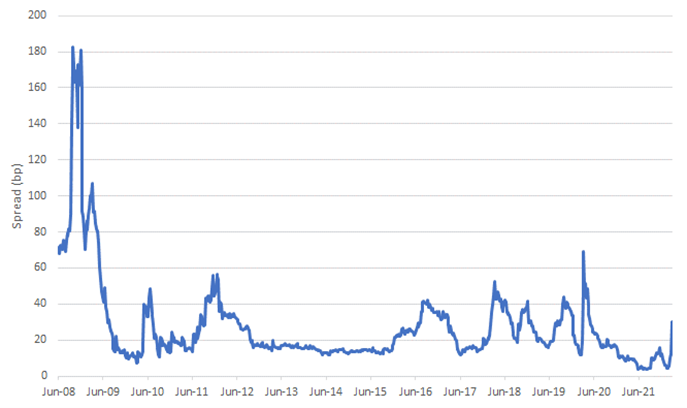

One emerging example is an arcane indicator known as the FRA/OIS spread. This indicator compares the spread on a short-term instrument known as a Forward Rate Agreement that has some embedded credit risk, against a rate known as the Overnight Indexed Swap, which has a similar duration but no credit risk. It has stirred back to life in recent weeks but is still far below prior peaks.

Figure 3: FRA/OIS spread

Source: Bloomberg

One factor that may be restraining greater moves in the FRA/OIS spread is the enormous amount of money deposited by banks at the Federal Reserve in what is known as the Reverse Repo (RRP) facility. Currently totaling US$1.5tn, this amount has grown steadily due to persistent quantitative easing. We would expect this excess cash to recede when quantitative tightening begins, but the potential silver lining is that it could be a useful bulwark against any issues that may arise in liquidity markets.

Implications for Credit

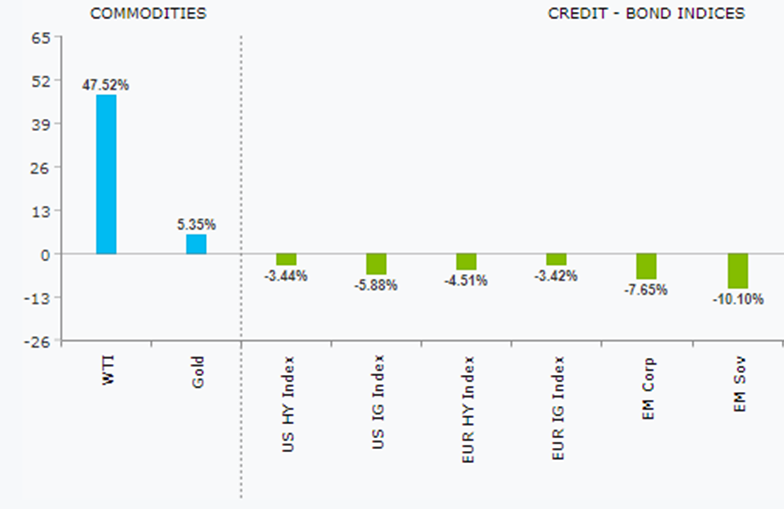

Credit investors are working through the process of discounting the many risks that a prolonged conflict in Europe may entail. But this is in addition to a broader theme of tighter financial conditions that market participants have been grappling with for the last six months. Credit spreads in all sectors of the market have been trending wider as a result. Indeed, in the US the YTD performance of investment-grade bonds has lagged the high-yield sector, while Europe and emerging markets are also in the negative. History tells us that widening trends can last for more than a year but do not have major impacts on the total return outcome. However, credit markets started this current cycle at historically tight levels, leaving open a chance that even a reversion to longer-term averages portends further widening from here. We find this a plausible argument and have reduced spread durations as a result.

Figure 4: Credit returns, 2022 YTD

Source: Citi

Interest rate markets are being pulled in opposite directions. On the one hand, central banks around the world have begun, and will continue to, respond to inflation by raising interest rates. On the other hand, the Ukraine conflict is creating a flight-to-safety trade that is limiting the increase in longer-term interest rates. Ultimately, we believe that the inflation response will become the dominant driver and thus interest rates are headed higher, but uncertainty will remain elevated for as long as hostilities continue in Ukraine.

Even securitised assets such as residential mortgage-backed securities are being marked wider. Higher interest rates will make borrowing for property more expensive, but the most important indicator for residential property is the employment situation. Australian employment indicators are at record levels, with wages growth expected to reach the RBA’s target of sustainably above three percent later this year. This gives us confidence that any volatility we are seeing in RMBS spreads is likely to be temporary.

Making investment decisions such as those suggested by Nathan Rothschild are never quite that simple. The underlying sentiment in the quote goes to the inherent unpredictability of the future, and also that when crisis creates volatility, it can also create opportunities for those willing or able to take a longer-term view.

Disclaimer: Please note that these are the views of the writer and not necessarily the views of Daintree Capital. This article does not take into account your investment objectives, particular needs or financial situation.