At the time of writing this article, a major war in Europe was entering its fourth week and the US Federal Reserve had increased interest rates for the first of several expected responses to annualised inflation of almost eight percent. Against this backdrop, one would be forgiven in relegating individual security analysis in favour of understanding the many macro implications that these prominent investment themes present. However, as active fund managers, we know that these periods can often be ideal environments to identify divergences that could translate into positive future returns. This note will highlight emerging opportunities in the bank hybrid sector by contrasting banks from Australia with the United States.

Compare recent results

Australian banks are showing sustained pressure on Net Interest Margins (NIM), due in part to low interest rates and intense competition. CBA remains the standout from a profitability perspective but is still finding it difficult to achieve sustainable earnings growth. Resilient property markets, rising commodity prices and full employment are all supportive of a positive outlook for asset quality.

The large American banks have a different balance sheet composition, favouring liquid assets such as cash and bonds, and lending to high quality corporate borrowers, with less emphasis on residential property. Thus, they are seen to be more exposed to the economic cycle and trade more like a cyclical stock. Despite the benefits to earnings that will flow from higher interest rates, rising borrowing costs will bring the economy closer to the threshold where delinquencies begin to rise.

Table 1: Key Metrics

| Company | Return on Equity | Net Interest Margin | CET1 Ratio | Cost/Income ratio |

| National Australia Bank | 10.4% | 1.53% | 18.0% | 45% |

| Commonwealth Bank | 14.9% | 2.00% | 19.4% | 46% |

| J.P. Morgan | 18.3% | 1.67% | 13.8% | 58% |

| Bank of America | 12.8% | 1.64% | 12.3% | 67% |

Source: Bloomberg, Company data

Compare the key risks

Intense competition has been a key feature of the Australian market for some time. American banks also face a vibrant competitive landscape, including financial startups of all shapes and size seeking to disintermediate traditional banking functions or attract younger, tech-native clientele. As has been observed in countless other industries, technology will continue to play a pivotal role in encouraging competition and driving operational efficiencies. Indeed, J.P. Morgan has committed to invest USD$700m over the next two years just to keep up with technological advancements.

The prospect of sustained inflation and uncertainty around the growth outlook is bringing asset quality and cost concerns to the fore. With strong employment markets in both Australia and the United States, the more immediate challenges are likely to come from rising employment costs. Australian banks have the advantage compared to their Pacific counterparts with cost/income ratios below 50%. Strong employment markets will, however, delay asset quality deteriorations by supporting serviceability of existing borrowings.

Compare share price performance

Positive factors for Australia mentioned earlier, such as higher commodity prices, has seen the local share market outperform most developed markets year-to-date. The prevailing inflationary environment has been a boon for the energy and resources sectors, which is also being impacted by the war in Ukraine.

US markets have been much more focussed on the trajectory of interest rates, and the associated impact on rich valuations, particularly of the high growth and mega-tech firms. This is in addition to the geopolitical concerns playing out across the Atlantic.

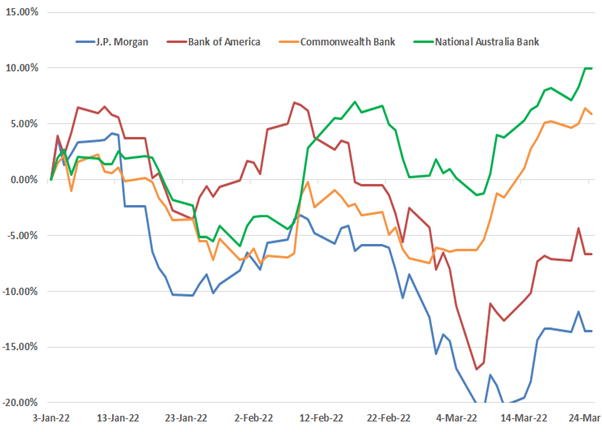

As a result, the share price performances of the banks have diverged. While CBA and NAB are positive year-to-date, JPM is the clear laggard of the group.

Figure 1: Share Price Performance, 2022 YTD

4 March 2022.

Compare hybrid yields

This divergence has also occurred in the hybrid securities of these issuers, implying a vastly different risk profile that we believe is unwarranted based on both fundamental and technical bases. The size of the movement implies that JPM and BAC may not call these securities at the first opportunity in 2026. We see this as a very low probability outcome. The dispersion is so wide we believe we have identified a viable opportunity to benefit from a medium-term reversal of this anomaly and have taken appropriate positions in our Hybrid Opportunities Fund (ASX: DHOF). Catalysts could include a moderation of expected future interest rate increases or a peaceful resolution to tensions in Ukraine.

Table 2: Hybrid Details

| Security | Yield to Next Call | Gross Running Yield | Premium/(Discount) to face value | Amount Outstanding |

| CBAPJ | 5.0% | 3.1% | 0.7% | A$1.2bn |

| NABPF | 4.9% | 4.4% | 6.9% | A$1.9bn |

| JPM 4.2% | 8.9% | 4.8% | (18.5%) | US$2bn |

| BAC 4.25% | 8.8% | 4.7% | (18.2%) | US$1.3bn |

Source: Bloomberg. Data as at 24 March 2022. All figures hedged to AUD unless stated otherwise.

Compare the pair

The four banks which are the subject of this article are all high-quality institutions. They face a range of challenges but have proven over time to be resilient and adaptable. Their disparate performance so far this year has attracted our attention, particularly when it comes to their hybrid securities. Despite similar terms to first call (mid-to-late 2026), the yields on offer are heavily biased toward JPM and BAC, even after currency risks are hedged back to AUD. While we do not expect a catalyst imminently, we are beginning to take positions now in line with the three-to-five year outlook we take in our Hybrid Opportunities Fund.

Disclaimer: Please note that these are the views of the writer and not necessarily the views of Daintree Capital. This article does not take into account your investment objectives, particular needs or financial situation.