Could inflation trigger the zombie apocalypse?

It should be no surprise that interest rates are rising around the world, and quickly! Governments, corporations, and households are now facing the real prospect of higher servicing and refinancing costs in the coming years. Companies with low productivity and already high interest costs are especially at risk, having come to be known as “zombie” companies.

Zombie company definition

There is no formal definition of a zombie firm, but they can be characterised by being highly leveraged but unable to repay principal amounts without additional borrowing, with poor growth prospects, and low and declining productivity. For this article our definition requires an interest coverage ratio (ICR) below one, and the replacement cost of the firm’s assets to be above the current market value of the firm, known as Tobin’s Q ratio. High leverage and low ICR help identify firms that cannot cover their debt-servicing costs, while a low market value reflects a dim assessment of its future prospects.

In a 2021 Bank for International Settlements (BIS) research paper, the authors identify other characteristics that can help investors to identify potential candidates. Zombie companies are much smaller than non-zombie firms, and less dynamic because they invest less in both physical and intellectual capital. Their operations tend to shrink in size over time, including overall levels of employment, and their labour and total factor productivity are on average only half that of other companies.

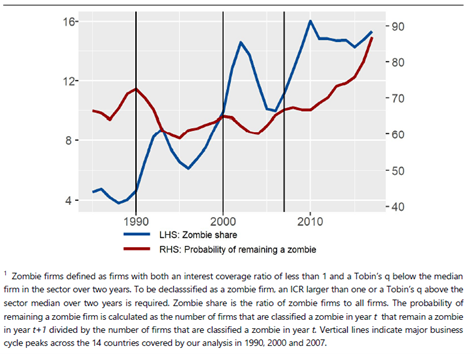

The proportion of firms classified as zombies has been steadily growing since 1990, coinciding with a multi-decade trend of falling interest rates. The core issue is that once rates begin to increase, firms that have become zombies struggle to recover. This has implications for credit investors, because zombie firms are far more likely to default on existing obligations when under significant stress.

Figure 1: Zombie corporations (in percent)

Source: Datastream Worldscope, Bank for International Settlements calculations

What other risks do zombies pose?

Following the GFC of 2008-09, when most major countries cut rates to zero (or below in Europe), central banks have made a couple of unsuccessful attempts to normalise the price of money. The first was in 2013 which ended in what came to be known as the Taper Tantrum. The second occurred during 2018-19, being ultimately abandoned after creating significant issues in short-term money markets. The inability to move sustainably from the lower bound supported the growth of zombie firms by allowing new financing to be available to just about any company that requested it.

Growth in the share of zombie companies across developed economies come with risks for the economy and for markets. Zombie firms divert (or more correctly, delay) resources from moving to their highest value use, impacting productivity. The BIS estimates that an increase in the zombie share in an economy by one percentage point lowers aggregate productivity growth by around 0.1 percentage points in the long run. This is an unwelcome headwind in an already low productivity environment.

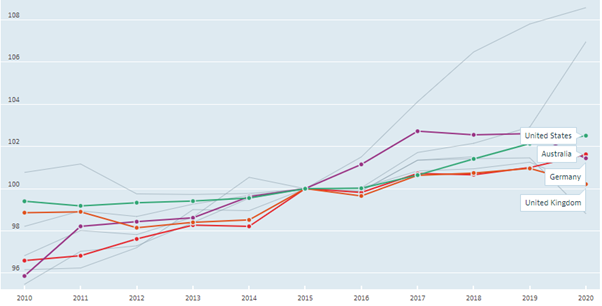

Figure 2: Multifactor productivity, annual (2015=100)

Source: OECD

Figure 1 demonstrates that once a firm falls into the zombie trap, it is almost impossible to escape. This carries greater significance as inflationary impulses grow. With the added pressure of rising input and employment costs, zombie firms are less likely to have the financial strength or market presence to carry these costs for any length of time, further reducing their competitiveness and potentially hastening their demise.

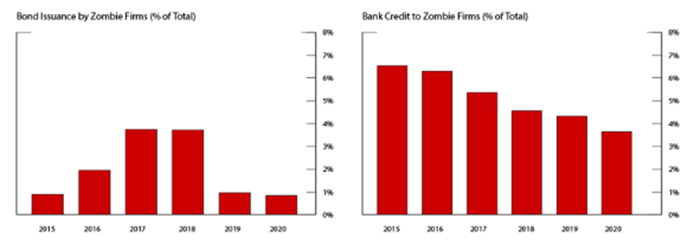

If defaults were to increase, the impacts are likely to be felt in traded debt markets and on bank balance sheets. While financial markets and banks recovered quickly from the early days of the pandemic, they were supported by massive liquidity and stimulus injections from governments and central banks. We expect no such support to be available in the years ahead, and indeed we expect financial conditions to tighten as interest rates return to more neutral levels. Estimates from the Federal Reserve suggest US exposures to zombie companies via its massive bond market or through bank lending are in single digits, but continued vigilance is warranted especially if inflation pressures persist, or liquidity needs to be rationed more actively.

Figure 3: Zombie firms share of financing, United States

Source: US Federal Reserve

Are there any zombies lurking in Daintree portfolios?

As an index-unaware manager, Daintree is not forced to lend to any issuer that does not meet its investment criteria. In addition, the above analysis looks specifically at non-financial companies across a plethora of industries, some of which we do not invest in due to ESG constraints. Daintree’s portfolio is diverse and encompasses financial companies and mortgage securities, among others, where this analysis carries less weight. Nevertheless, we reviewed a range of metrics for the companies that may be at risk of zombie status.

We were not surprised by the results because of our bias for investment-grade, mature companies in preferred industries that have the size, presence, and flexibility to adjust to changing conditions. The average interest coverage ratio across the portfolios was 8.5x, with an average Tobin’s q ratio of 1.3. While some companies have either an ICR below 2 or Tobin’s q below 1, no company has both at the same time, confirming that no zombies are to be found in Daintree portfolios. As conditions evolve over coming months and years, we will continue to periodically review these numbers to ensure that Daintree remains a zombie-free zone.

Conclusion

Despite there being differences in definition, zombie companies are prime candidates for default or failure when financial conditions tighten, or economic conditions deteriorate. We believe the next 2-3 years will pose significant challenges for any company too reliant on debt or those with weak fundamentals. While the scale of the problem suggests it will not become a systemic issue of itself, we believe that these issues could compound on top of a default cycle brought about by contraction in economic activity from lingering supply chain issues or excessive interest rate increases. The most effective way to mitigate these risks is to simply avoid exposure as much as possible and remain vigilant as conditions evolve. The tide is going out and we expect to encounter some naked zombies in the years ahead.

Disclaimer: Please note that these are the views of the writer and not necessarily the views of Daintree Capital. This article does not take into account your investment objectives, particular needs or financial situation.