- The trend for bond prices and performance has changed substantially, driven by the emergence of inflation.

- The reliance on duration as part of a broad-based fixed income allocation is challenged, with implications for portfolio construction.

- Consider fixed income strategies that can manage duration, credit, ESG and other risk factors in an absolute return manner.

Fixed income has been battling through a perfect storm of challenges in 2022. Long having been relied upon as the more dependable portfolio allocation, many sectors are seeing their worst start to a year since the Second World War. Against a backdrop of inflation and growing concern around the growth outlook, many investors are finding that passive, duration-heavy, index-aware fixed income allocations are not providing the stabilising effect that has been its key attraction for decades. We believe investors need to accept that reversion to the patterns of performance observed so far this century is unlikely any time soon.

A reliable friend?

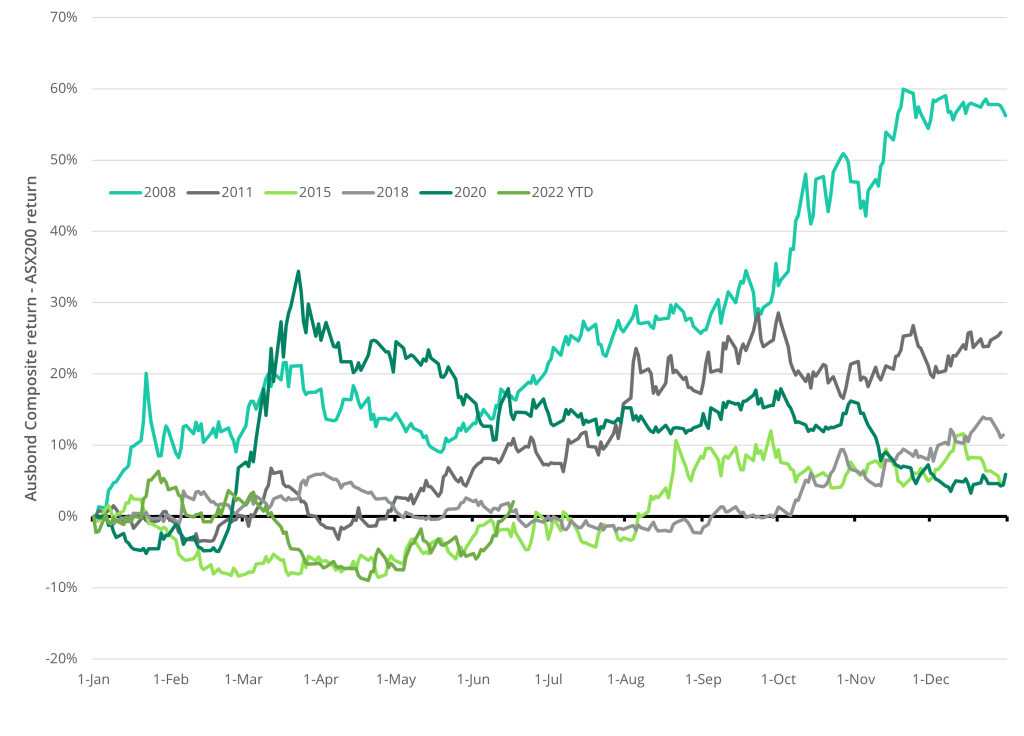

One of the most ubiquitous and well-known asset allocation models is the 60/40 portfolio, where a 60% allocation to risky assets (often equities) is balanced by a 40% allocation to defensive assets (usually bonds or fixed income). Bonds provided this support because central banks had the ability and the determination to respond to economic challenges by cutting interest rates. This developed into a multi-decade trend that was positive for bond prices and performance. Therefore, in the years since 2007 when Australian equities have had a year-ended negative return, Figure 1 shows that the Ausbond Composite index always outperformed equities; and generated a positive return.

Figure 1: Return differences in years with equity drawdowns

Source: Bloomberg

Surging inflation, geopolitical concerns and challenged growth outlooks have put an abrupt end to this trend. Central banks must increase interest rates to bring inflation back under control, seeking to balance this goal with the inevitable impacts on the broader economy. However, the effect has been fading over time, with the benefit in years since 2011 averaging in the single digits. This suggests that the biggest benefits had already accrued by the time the European debt crisis of 2011 roiled global markets more than a decade ago.

Rebasing expectations necessary for future

We believe that the future will be different from the past regarding fixed income’s role in portfolio construction. However, it is useful to look back and understand how a broad-based fixed income allocation (proxied by the Ausbond Composite index) has added value compared to cash over the long term.

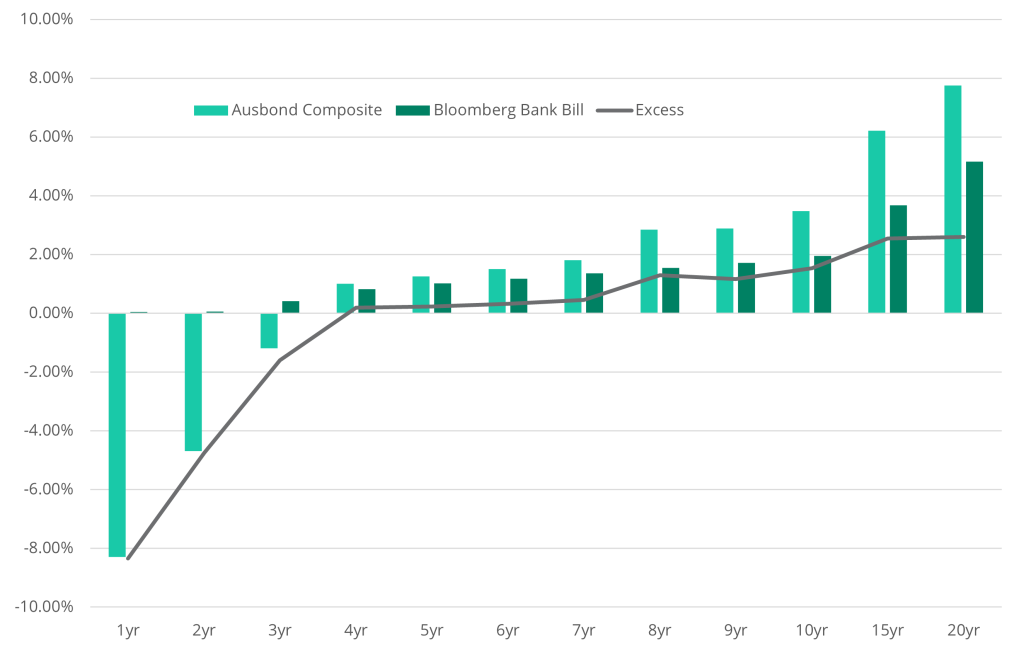

Figure 2: Ausbond Composite annual returns (per annum)

Source: Bloomberg

The data reinforces the point made in the previous section, with the excess return over cash diminishing over time as the index came to be increasingly driven by movements in interest rates (via higher underlying duration), supplanting coupon income as the dominant return driver.

The experience of 2022 has exposed a major weakness in passive fixed income. The reliance on duration is becoming painfully apparent as the effects on returns are strikingly symmetrical as interest rates move higher. The longer the current cycle continues, the worse the drawdown will be.

Therefore, we believe investors have arrived at a crossroads. While recent losses are painful, they shouldn’t cloud a rational assessment of the future. It may be tempting to maintain your position and wait for a recovery, but in our view the events of this year have demonstrated that the game has changed.

The 60/40 portfolio looking a little “un”- balanced

Another of the widely accepted and relied upon pearls of investing wisdom has been crushed so far in 2022. Fixed income, overall, has had its worst start to a year in living memory, and has thus not held up its side of the bargain regarding a standard 60/40 portfolio when equities have also had a torrid year to date. Indeed, in Australia the quantum of losses in the Ausbond Composite are close to the falls observed in the ASX 200 equity index.

Figure 3: Year-ended 60/40 portfolio performance

Source: Bloomberg

Clearly, this year is just one example and not proof that the 60/40 approach has been invalidated, but it should certainly make all investors stop and consider what the 40% in defensive assets might represent going forward. If we are correct and a circa 40-year trend is turning in front of our eyes, a passive-index, passive-duration style of fixed income exposure is bound to disappoint both from relative return and risk mitigation standpoints. In other words, the experience of 2022 could become the norm rather than the exception for the foreseeable future.

Conclusion

The concept of the 60/40 portfolio has been sternly tested this year. While we think the overall approach retains merit, we believe it can be significantly improved by thinking more closely about which assets make up the defensive portion of the portfolio. The best we can say about passive, long-duration fixed income approaches is that they will be less predictable in the years ahead and much less able to dampen volatility in growth assets. Furthermore, the nature of fixed income indices means recovery in coupon income will take several years to flow through to investors.

There are other options. Active fixed income managers such as Daintree Capital can manage interest rate, credit, ESG and liquidity risks. By adjusting these parameters, capital preservation can be prioritised when markets become volatile or unpredictable, after which the portfolio can be pivoted toward greater income generation once the outlook improves. Therefore, rather than letting the popular and widely used concept of the 60/40 portfolio decay, perhaps now is the time to review the recipe to revitalise its credentials for a changing world.

Disclaimer: Please note that these are the views of the writer and not necessarily the views of Daintree Capital. This article does not take into account your investment objectives, particular needs or financial situation.