Impact of higher interest rates on the Australian Residential Mortgage-Backed Securities (RMBS) market

The Australian Residential Mortgage-Backed Securities (RMBS) market is a major component of the Australian credit markets. The sector has been supported by low interest rates, rising house prices and a competitive lending environment over the last few years. This period is now coming to an end with the Reserve Bank of Australia (RBA) on a tightening path in line with its global developed-market peers to fight multi-decade high inflation while property prices are starting to fall after experiencing very strong growth after the Covid-19 pandemic. We look at how higher interest rates and falling property prices impact this significant portion of the Australian fixed income sector.

As fixed income investors, we mainly focus on the downside risks. The main concern for holding RMBS securities is whether or not homeowners can service their mortgages. The inability to service mortgage debt increases delinquencies and defaults, stressing the securitization structure of these securities and impacting the cash flow received on the mortgage pool and its distribution throughout the tranches of the RMBS. The ability to service on a macro level is largely impacted by cost of living, interest rates and employment.

Cost of Living

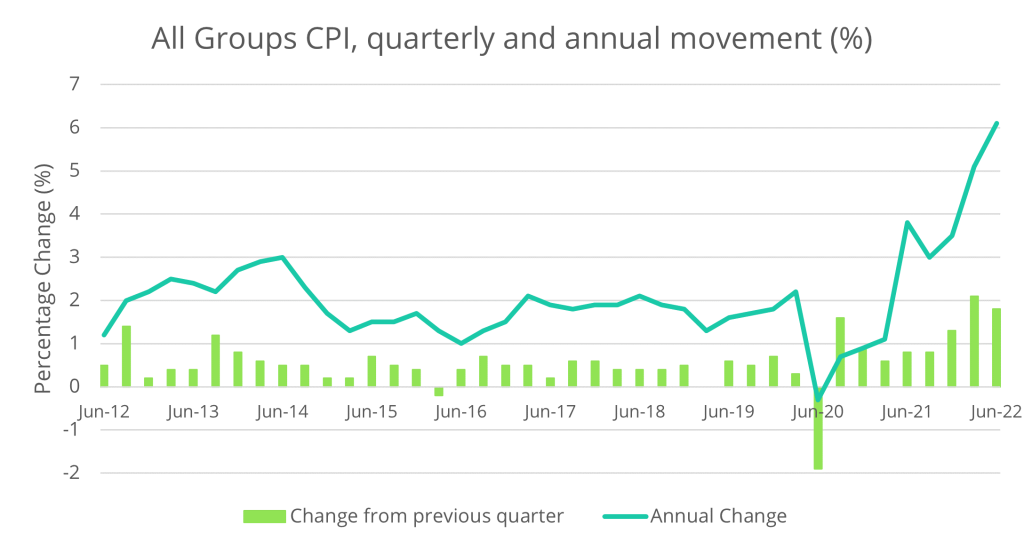

There is no shortage of media coverage about the rising cost of living and inflationary pressures in the economy. The Australian Bureau of Statistics (ABS) recently released the Consumer Price Index for Australia over the year for the June 22 quarter which came in at 6.1%. This was driven by significant price rises among new dwelling purchases, automotive fuel, furniture and food and non-alcoholic beverages. This level of inflation is the highest in more than a decade, which along with stagnant wage growth, is increasing pressure on household budgets.

Source: Australian Bureau of Statistics (ABS)

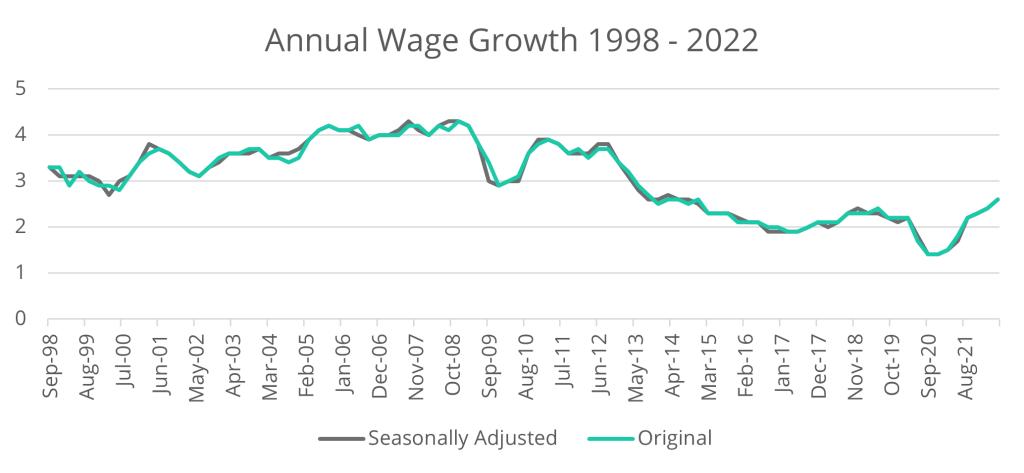

Source: Australian Bureau of Statistics (ABS)

Rising Interest Rates

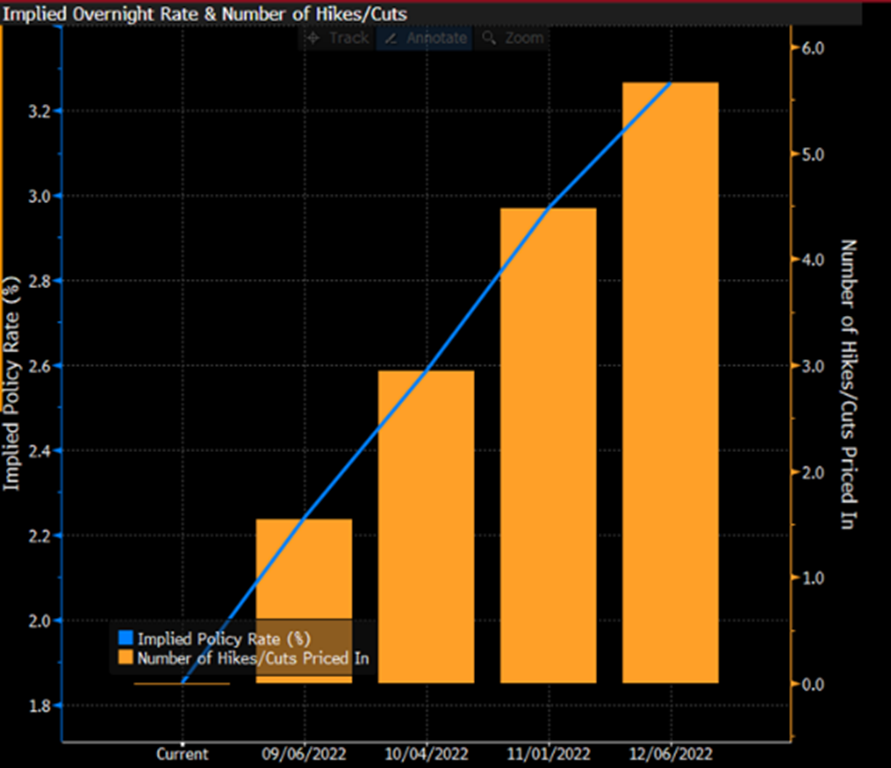

Since May 2022, the RBA has raised rates four times, with the cash rate increasing from 0.1% to 1.85% currently. The last time the cash rate was at this level was during 2016 where it was at 2% before being cut to 1.5%. The futures market is implying that rates will reach over 3.2% by the end of the year. If we do reach over 3.2%, the last time rates were at this level was at the end of 2012, more than 10 years ago.

Source: Bloomberg

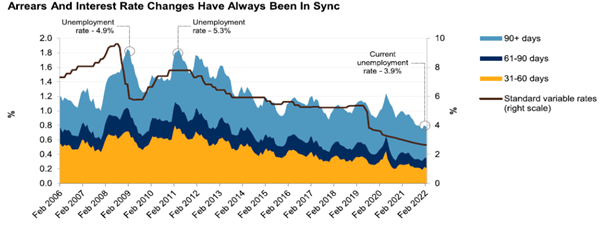

Standard & Poor’s (S&P) have produced research going back to 2006 looking at the relationship between interest rate changes and arrears, showing a positive correlation to increases in variable rates with delinquencies. Since 2010, Australian borrowers had continual lower rates due to global easing policies to mitigate the impacts of various financial crises. This is now due to change. The shift in stance from central banks around the world needing to increase rates to help fight inflation implies a strong probability that delinquencies and defaults spike up from their current levels.

Source: S&P Global Ratings, Reserve Bank of Australia, Australian Bureau of Statistics

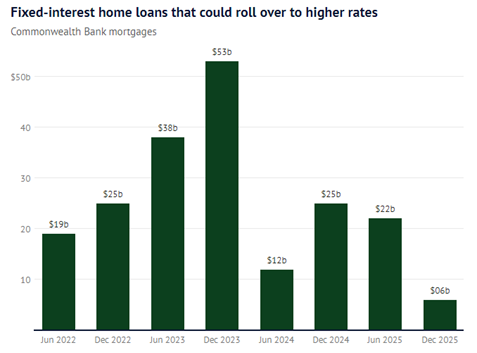

In addition to the likely rise of delinquencies due to higher interest rates, borrowers who had fixed loans at a low rate are about to roll off, with the majority of fixed rates expiring in 2023 and switching back to a variable rate at much higher levels. This “rate shock” is expected to increase delinquencies as many borrowers on fixed rate loans are looking at an increase of at least 1.75% above the rate they were on before.

Source: Commonwealth Bank

Employment

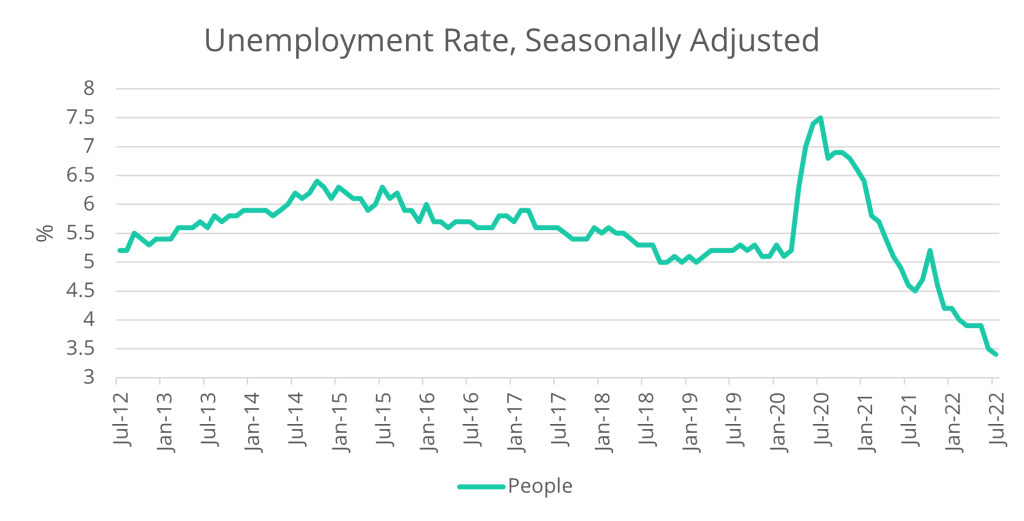

While higher interest rates and a higher cost of living will stress mortgage serviceability and increase delinquencies, the Australian unemployment rate has remained at decade lows which has tempered the transition from arrears to defaults. Strong labour market conditions persist and as long as borrowers are employed, the full recourse nature of mortgage loans and housing as a fundamental need will see a reprioritisation of spending habits to stay on top of mortgage payments.

Source: Australian Bureau of Statistics (ABS)

Home Prices

With the housing market starting to cool after very strong growth since the pandemic, the impact of property price declines can exacerbate existing mortgage pressures by restricting borrowers’ options to self-manage their way out of arrears by selling their property or refinancing an existing home loan. More highly leveraged loans are more likely to experience arrears. Faced with lower property prices, such borrowers could have more difficulty in refinancing. This means arrears could increase more for this cohort than for others.

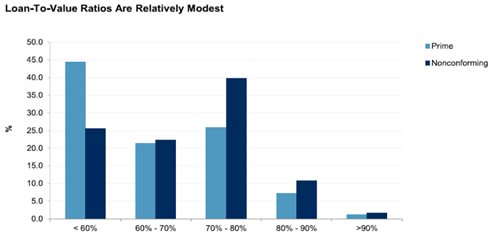

The relatively modest loan-to-value ratios in the Australian mortgage pool, due to built-up equity and long seasoning, will limit the impact on delinquencies due to lower property prices. Only a small portion of the mortgage pool has loan to value ratios over 80%, which requires Lender’s Mortgage Insurance (LMI) and insures the lenders against some losses, further protecting the collateral pool.

Source: Standard & Poors (S&P)

Prime home loan: standard mortgage loan that meets credit score requirements and ability to provide particular documentation.

Non-confirming home loan: used for home loans that don’t typically conform to the major banks’ standard loan criteria of a prime loan.

Putting It All Together

With Australian mortgage borrowers saddled with large household debt and high exposure to variable rates, the current environment of a higher costs of living, falling housing prices and rising interest rates will test the resilience of the Australian RMBS market. The RMBS sector’s minimal exposure to fixed-rate loans will also limit arrears increases after borrowers shift to higher rates when their fixed-rate periods end. While the fundamentals and historical evidence suggest that there is a strong probability of increased arrears and hardship, the employment landscape currently remains strong and will reduce the prevalence of defaults.

There are protections in the market where the Australian Prudential Regulation Authority (APRA) dictates a serviceability buffer of 3% on top of the product rate as a way of stress testing a borrower’s ability to withstand fluctuations in interest rates. Mortgage lenders also calculate serviceability via the Household Expenditure Method (HEM), a minimum benchmark used for living expense allowances. These measures promote responsible lending and standards of mortgages in the RMBS collateral pools and will increase the quality of mortgages compared to the last few years of low interest rates.

While we expect more arrears in the non-conforming versus prime mortgage pools due to higher loan balances, lower seasoning and lower quality borrowers; the cumulative gross losses of both the prime and non-conforming RMBS structures have not reached the levels of subordination within the investment grade rated tranches. Taking into account the high level of recovery in Australian real estate, the low level of losses since the GFC and the level of subordination provided by each tranche, in our opinion the structures remain very sound.

The pool characteristics of each RMBS deal are different, so there are some which will be riskier than others. This is where scenario analysis, stress testing and analysing the underlying collateral pool play an important role in assessing the structures of Australian RMBS securities. Each rated tranche has a required level of subordination to achieve the rating based on an “archetypical” pool of Australian mortgages. We stress these beyond the rating agency assumptions to ensure the integrity and soundness of each RMBS deal’s structure.

While the Australian RMBS market will undergo a more difficult period than witnessed over the last decade due to rising interest rates, falling house prices and higher costs of living, we believe the sector will remain resilient in these challenging times.

Disclaimer: Please note that these are the views of the author Simon Wang, Senior Credit Analyst at Daintree, and are not necessarily the views of Daintree. This article does not take into account your investment objectives, particular needs or financial situation and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation.