Key Points

- Growth will moderate next year, but the risk of recession is higher in Europe and economies facing the most acute energy shortages.

- Financial and energy markets remain vulnerable to shocks driven by variable liquidity and structural shortages, respectively.

- Inflation will moderate in 2023 but the path back to desired targets will be hampered by conditions in the real economy that are sending mixed messages.

- Cash rates will most likely continue a slower but upward path before a prolonged pause as the full effect of prior increases work through the system

- Credit spreads have had a major correction this year, but strong corporate fundamentals and emerging relative value give us confidence that 2023 can be a solid year for credit.

This year has been arduous for invests as the consequences of decisions made in 2020 have manifested across global markets. Nowhere is this plainer than in the re-emergence of widespread inflation following decades of moderation. Tightening financial conditions negatively impacted asset returns, with a few notable exceptions.

While 2022 has been difficult, a new year looms just over the horizon. In a positive sense, acute supply chain issues have largely resolved, unemployment is at or near record lows even as the prospects of recession rise in major developed economies, and corporate balance sheets enter 2023 in a strong position, albeit with downside risks. On the other hand, the prospect of energy shortages and supply disruptions will weigh on the growth outlook, especially if the war in Ukraine drags on. Moreover, issues arising from interest rate normalisation and ongoing liquidity removal could see volatility in asset prices persist.

Growth

As the new year approaches the growth outlook remains fragile and exposed to downward revision. Indeed, according to the IMF, a large proportion of the global economy, both developed and emerging, have risks of growth downgrades at the same likelihood as during COVID and during the European debt crisis. The deterioration has been more gradual in 2022, but we expect the interest rate normalisation process to continue into next year even as the full impact of prior rate increases is yet to be fully reflected in growth outcomes.

Figure 1: Near-term growth at risk, global aggregate

Source: IMF

Aggregate demand remains too strong, hampering efforts of central banks to address inflationary dynamics. Investors expect a reasonably quick reversion to desired targets, in contrast to the historical data, especially when inflation peaks above eight percent. While central banks have vigorously increased interest rates to address this excess demand, approaches are beginning to diverge. For example, in recent months Australian and Canadian central banks have slowed the pace of rate increases, citing the delayed impact of prior actions and growing risks to economic growth and property markets. In contrast, the RBNZ increased the pace of rate hikes to a record 75 basis points in November following a string of 50 basis point moves, citing its ongoing discomfort with elevated inflation and unwavering determination to bring it under control.

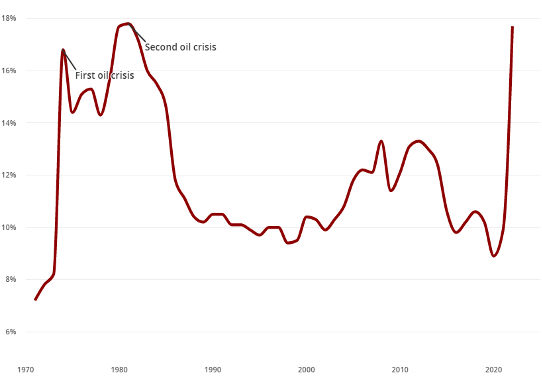

While central bank actions will have direct impacts on many stakeholders, other factors such as energy costs are pervasive across the economy. Disruptions caused by the war in Ukraine, a global lack of energy supplies due to insufficient investment in new capacity, and impaired output of refined materials mean that expenditure on finished energy products (such as petroleum, diesel, etc) as a proportion of GDP is estimated to be approximately 18%, a level observed during the hugely disruptive oil shocks of the 1970’s.

Figure 2: Expenditure on finished energy products (% of GDP)

Source: OECD

The Daintree View: Central banks will get their wish of slower growth in 2023, although the data suggests that recession is more likely in some markets than others. However, central banks have a limited toolkit with which to execute their objectives, leaving them open to shocks over which they have little influence, such as energy prices.

Markets

With energy producers that notable exception, most asset classes have had a year to forget. While much attention remains on equities, private markets and cryptocurrencies, upheaval in the typically staid world of fixed income has been seismic. Elevated volatility throughout the year has pushed the widely followed MOVE Index (the bond market equivalent of the VIX) to progressive highs, driven by the rapid pace of tightening by central banks and uncertainty around peak inflation levels. As more data starts to confirm that core inflation has, or may soon peak, we expect the MOVE to moderate.

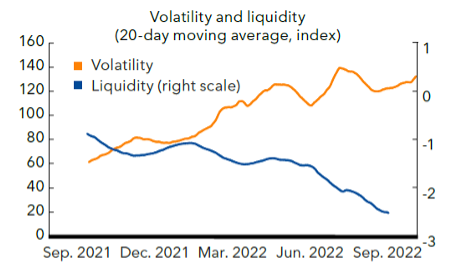

The more immediate concern going into 2023 is weakening and variable liquidity conditions, even in the pivotal market for US Treasuries, Persistent poor liquidity has the potential to magnify yield movements and obscure price discover, complicating the critical process of determining the closely watched putative risk-free asset.

Figure 3: Bond market volatility and liquidity indices

Source: IMF Global Financial Stability Report

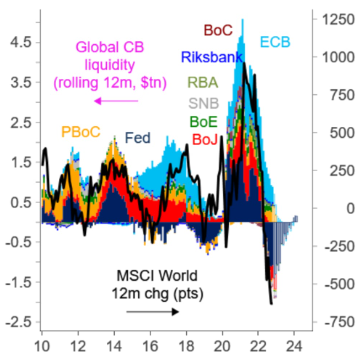

Liquidity is crucial for the smooth delivery of quantitative tightening (QT), the process where central banks allow bonds held on its balance sheet to mature without reinvesting the proceeds. Central banks have accumulated enormous holding of bonds, the reversal of which remains a daunting task. Recent data suggests that the weekly changes in global liquidity have been a good short-term predictor of risk asset performance. Progress to date has been limited and slow. In addition, other liquidity pools such as the Federal Reserve’s Reverse Repo Facility (RRP) have remained popular, attracting excess liquidity at a risk-free return just below the Fed Funds rate.

Now that the reserve impulse is negative, and likely to remain so for the time being, risk assets remain vulnerable to outsized moves. The sheer size of the QT task requires a degree of caution, in our view. With trillions of dollars moving around highly connected global markets, decisions made by the FED could have unintended consequences elsewhere in the world.

Figure 4: Central bna reserves changes

Source: Citi

One of these consequences this year has been a resurgent USD. The global reserve currency has been trending strongly since May 2021, despite a poor month in November 2022 that turned out to be the weakest monthly performance since May 2009. Even after such a poor month, the USD index is only back to levels last seen in August, 17% above post-pandemic lows.

The Daintree View: Volatility is likely to remain elevated as the market focus shifts from inflation to growth. This will happen while central banks seek to keep financial conditions restrictive and reduce their collective balance sheet. The sheer size of the task and deeply interconnected markets provide only a narrow path to success.

Inflation

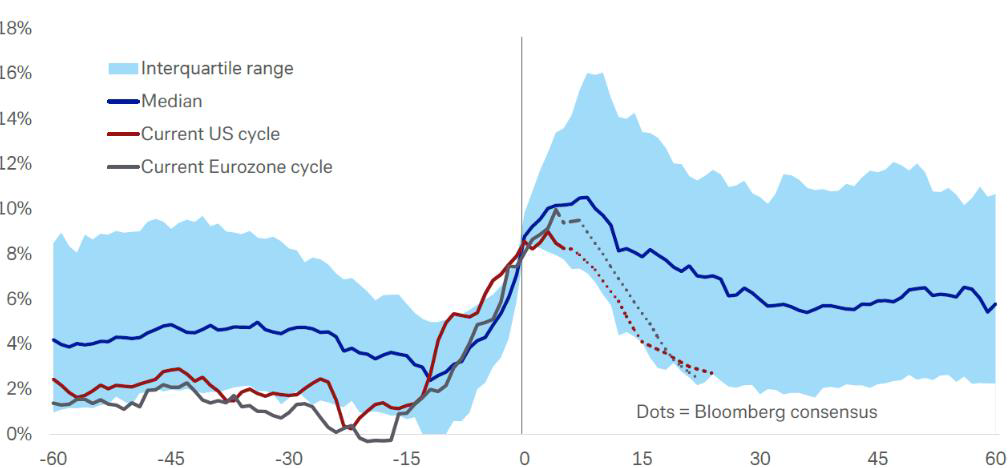

Countless column inches have been devoted to dissecting the components and outlook for inflation as the year has progressed. Revisiting this type of analysis will add little to the current discussion, but we believe that what is most important is ensuring that inflation expectations remain anchored at or near levels desired by central banks. Based on inflation breakeven yields, markets remain comfortable that inflation will return to target over the next 18-24 months. However, based on prior periods where inflation has reached at least 8%, persistence at higher levels has been stronger and the normalisation period has taken considerably longer than markets currently have priced. Therefore, while statistically possible, there is little room for error based on current expectations, and little room for new supply or energy shocks that put an economic “soft-landing” at risk.

Figure 5: Inflation paths from elevated levels

Source: Deutsche Bank

The cause of sticky inflation is more likely to come from the services sector, underpinned by labour shortages. Even if demand can be constrained to have an impact on inflation while avoiding a deep recession, upward wage pressure is evident globally. For example, in the US a high “quit-rate” is being observed among skilled workers seeking a wage rise through job switching. In Australia, labour shortages are evident in several industries including hospitality and construction, although wage pressures have been less evident than other developed markets. Migration is recovering but not quickly enough to satisfy demand, leaving open the possibility of wage growth accelerating next year. The newly legislated Secure Jobs, Better Pay bill has not yet had sufficient time to influence wage outcomes, but business has expressed concerns about added cost and complexity that would work counter to the desired outcomes of the bill.

The Daintree View: Inflation will moderate in 2023 but not return to desired ranges unless a severe recession takes hold. Wage demands will remain elevated or intensify, via shortages or opportunistic turnover. In Australia, big changes to industrial relations legislation provides an additional, unpredictable dynamic to the wages and employment outlook.

Interest Rates

Despite our expectation for inflation to moderate through 2023, cash rates will continue to rise. The only thing worse than persistent above-target inflation are dislodged inflation expectations that create the foundation for wage-price spirals. Therefore, once cash rates are sufficiently restrictive to address inflationary concerns, we expect those rates to be sustained for a period to ensure price stability has been re-established. In other words, we think the global economy is sufficiently robust to absorb expected cash rate increases, causing a deceleration in growth momentum without fully derailing the expansionary impulse.

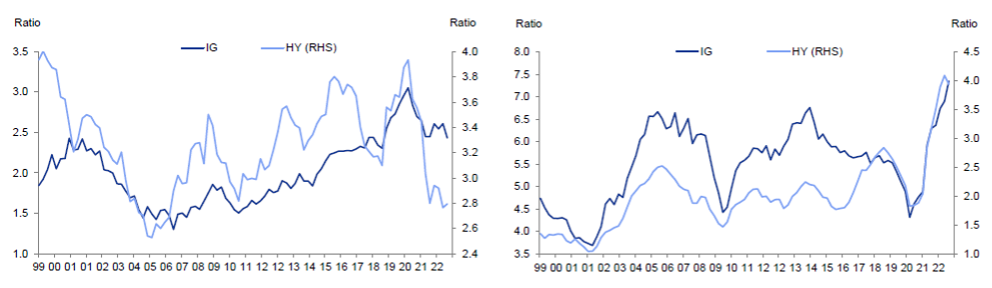

Investors will respond positively when the pace of rate hikes slows. Borrowers, on the other hand, will contend with higher costs of funding and more selective credit availability, straining weak and exposed borrowers and sectors. These include highly leveraged balance sheets, sectors with high reliance on energy inputs such as transport and agriculture, and smaller firms lacking pricing power and the ability to pass on higher input costs. Overall, corporate bond issuers are well equipped to navigate a period of tighter financial conditions. Leverage is well contained, especially in the lower-rated High Yield sector of the market, while the ability to service that debt (Interest Cover) is the highest it has been in decades across the credit spectrum.

Figure 6: US Corporate Balance Sheet Summary, Net Debt to EBITDA (left) and Interest Cover

Source: Goldman Sachs. IG = Investment Grade, HY = High Yield

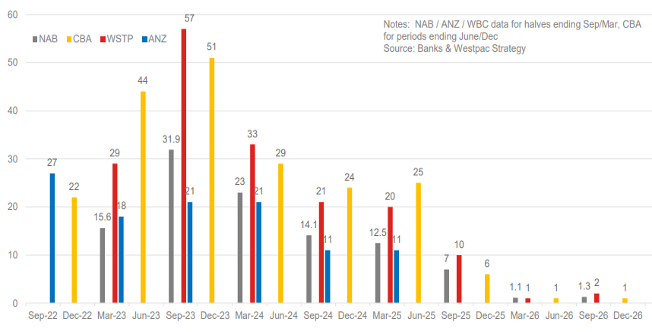

In Australia, the transmission of monetary policy will occur most directly through the mortgage channel. Many borrowers took advantage of generationally low interest rates to fix those rates for three years on average. However, by the end of 2023 some $289bn of these cheap loans, from just the four major banks, will reset to a floating rate several percentage points higher. With market expectations for up to 75bp of additional tightening by June 2023, the shock to household budgets will be drastic and direct. Furthermore, property investors will be forced to increase rents at a time where the supply of rental stock is very low.

Figure 7: Fixed mortgage roll-off, ($bn)

Source: Company data, Westpac Research

Higher mortgage commitments are already burdening households, which along with rising electricity prices and other cost-of-living pressures, are causing significant anxiety. The data paints a confusing picture. Consumer spending in most discretionary categories remains strong, while measures of consumer confidence are at levels last seen during the GFC and the beginning of COVID. Falling savings rates go some way to explaining the persistent consumption pattern, but consumers usually increase their rate of saving when they are concerned for the future. Determining how these trends evolve and responding appropriately will be pivotal for central banks and policymakers next year.

The Daintree view: Cash rates will continue to rise next year, even as inflation and growth are expected to moderate. Central banks will want to be certain that inflation has been contained at or near target before even contemplating the next easing cycle. Therefore, it is more likely that when cash rates peak, they will remain at these levels for some time. The only caveat to this would be in the event of a severe and unexpected deterioration in activity that places extreme stress on employment markets or financial stability, necessitating a policy reversal.

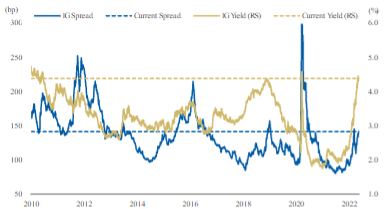

Credit Spreads

Corporate credit spreads have undergone a multi-standard deviation correction during 2022. That said, while all-in yields are close to multi-year highs, credit spreads themselves have not displayed the elevated volatility observed in sovereign bond markets. As noted earlier, we think this can be partly explained by the general strength of corporate balance sheets. Nevertheless, credit spreads will find it hard to plateau until there is more clarity on inflation, interest rate and growth trajectories.

Figure 8: Investment Grade Spreads and Yields, USD

Source: Morgan Stanley

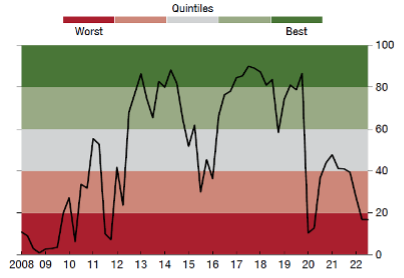

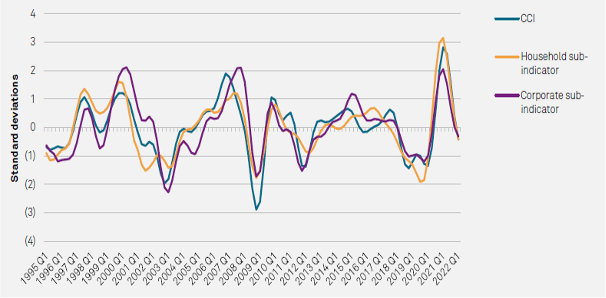

Furthermore, analysis from S&P suggests that the hangover from the COVID pandemic has yet to fully work through the system, according to its proprietary Credit Cycle Indicator which operates with a significant lag of six to 10 quarters. A global growth slowdown may catalyse a new credit cycle in 2024, but there is little evidence of this yet in the data.

Figure 9: S&P Credit Cycle Indicator

Source: S&P Global Ratings

The Daintree view: We are quite constructive on the medium-term outlook for credit spreads, based on a corporate sector with strong fundamentals and our expectation that the global economy can avoid a severe recessionary scenario. More clarity on the terminal paths for inflation and interest rates is needed before credit spreads begin to tighten, a process that is still months away, in our view.

The view from the top of the wall…

Very few people accurately predicted even one of the major events that impacted the economy and markets this year, let alone a confluence of events including inflation, war and volatility. While markets are forward looking and attempt to discount estimates about the future into current prices, there will always be improbable events that occur. Charting a path up the Wall of Worry might secure a better vantage point to assess the broader landscape, but the horizon is a formidable threshold beyond which the future lies. Daintree portfolios reflect the views expressed in this note, seeking as always to balance our core principles of capital preservation, income generation and risk management.

Disclaimer: Please note that these are the views of the author Brad Dunn, Senior Credit Analyst at Daintree, and are not necessarily the views of Daintree. This article does not take into account your investment objectives, particular needs or financial situation and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation.