Like any active investment manager operating in the broader fixed income space, Daintree Capital is constantly seeking to unearth hidden value across all parts of the fixed income and credit markets.

Hybrid securities are one such sector that we believe deserve close consideration, having recently been thrust into the spotlight following the acquisition of Credit Suisse by Swiss counterpart UBS.

Hybrids are unique securities, most commonly issued by banks, that combine elements of debt securities with some equity-like components. These types of securities are issued globally, thereby magnifying and increasing the scope to find compelling investment opportunities.

Ratings arbitrage

While hybrid securities are typically rated at-or-near investment grade, their issuers are rated multiple notches higher.

To maintain these strong ratings, financial performance of the issuer is closely scrutinised, including the structure of their balance sheet. There are strong incentives for the issuer to balance profitability and capitalisation.

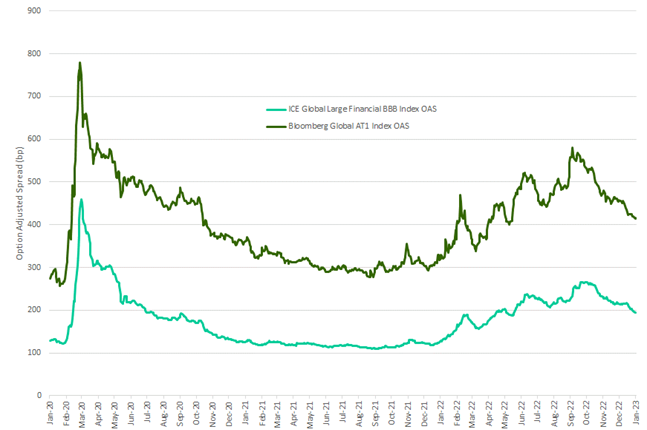

A major reason why hybrids have emerged on our radar is due to the comparison of spreads relative to credit rating. Hybrids offer an average spread 2.3%p.a. higher than a broad-based index of financial issuers with a BBB credit rating, and nearly 3%p.a. on a spread duration-matched basis.

Figure 1: Hybrid spreads compare favourably to other Financial BBB spreads

Source: Bloomberg, ICE-BAML

At face value this makes sense because hybrids are complex securities. Three features in particular warrant closer consideration:

1) The ability of the issuer to cancel distributions. Theoretically, this is quite easy for the issuer to do, however they would have to also suspend paying dividends to ordinary shareholders, a choice that would undoubtedly have seriously damaging ramifications to the issuer’s corporate reputation.

2) A regulator’s discretionary power to write-down or convert hybrids to equity. Hybrids are designed to be “loss-absorbing”. In simple terms, this means that they are designed to be a reserve source of ordinary equity should the issuer ever get into significant financial difficulty.

3) The possibility that share price movements can delay a conversion or redemption indefinitely. Australian hybrids are designed to have optional and mandatory dates where the issuer can repurchase the security or convert to equity. However, for this to happen the equity price needs to be above a certain level to avoid unnecessary dilution.

While APRA has yet to enforce its non-viability trigger, other regulators have needed to draw on similar extraordinary powers. The most recent, and largest, example is playing out as we speak in relation to Credit Suisse. In the years following the GFC, banks requiring intervention have generally been smaller, geographically concentrated and poorly capitalised with below-average lending portfolios. Credit Suisse arguably did not reflect any of these criteria and yet was still required to write down the value of its hybrid securities as a condition of the deal brokered by the authorities.

We believe that the best way to manage this risk in a portfolio context is to ensure meaningful diversification and take an active approach by favouring industry leaders in strong developed markets.

Active can add value

From a local standpoint, there is widespread confidence in the integrity of the Australian banking sector, a view that we share.

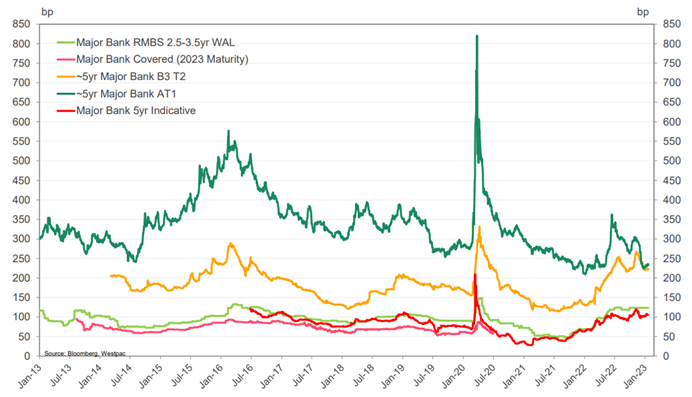

This confidence, however, is contributing to some unusual results in Australian bank capital markets. For example, while spreads of subordinated notes (yellow line in Figure 2) widened during 2022, listed hybrid securities (dark green line) ended the year flat and at the same level as subordinated notes.

Figure 2: Spreads to Swap

Source: Bloomberg, Westpac

This result suggests that either:

- a) subordinated notes are historically cheap to hybrids, or

- b) hybrids are expensive.

While some one-off factors have created uncertainty in subordinated note markets in recent months, our view is that the reversal of hybrid spreads starting in July 2022 is more unusual in its departure from historical precedent.

Hybrids should trade with wider spreads than subordinated notes to reflect their place in the capital structure, an assertion being borne out by the Credit Suisse episode. Furthermore, hybrids provide valuable optionality to the issuer, for which the investor should be adequately compensated.

Retail investors are attracted to Australian hybrids because of the availability of franking credits, but in our experience very few can adequately assess and price the embedded optionality.

Therefore, while Australian hybrid spreads have held strong in difficult markets, we cannot be sure that current dynamics will persist indefinitely.

A world of choice

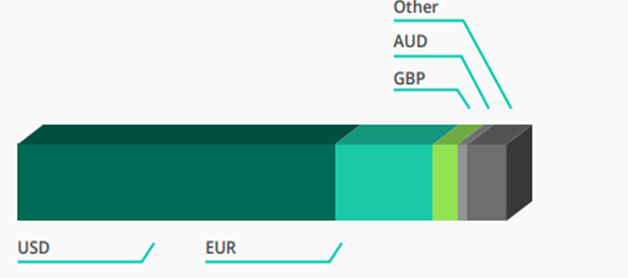

The Australian hybrid market represents only 4% of the global category. Within the local market, approximately 85% of market capitalisation is represented by just four issuers.

Figure 3: Hybrid issuance by currency

Source: Bloomberg, Daintree

There are dozens of high-quality issuers in developed economies that offer the hybrid investor meaningful diversification. This includes:

- Issuer diversification – spreading risk away from Australia.

- Security diversification – choice of fixed or floating interest rates, varied terms and conditions and different regulatory priorities.

- Market diversification – listed and unlisted opportunities.

Broadening the universe brings with it return advantages.

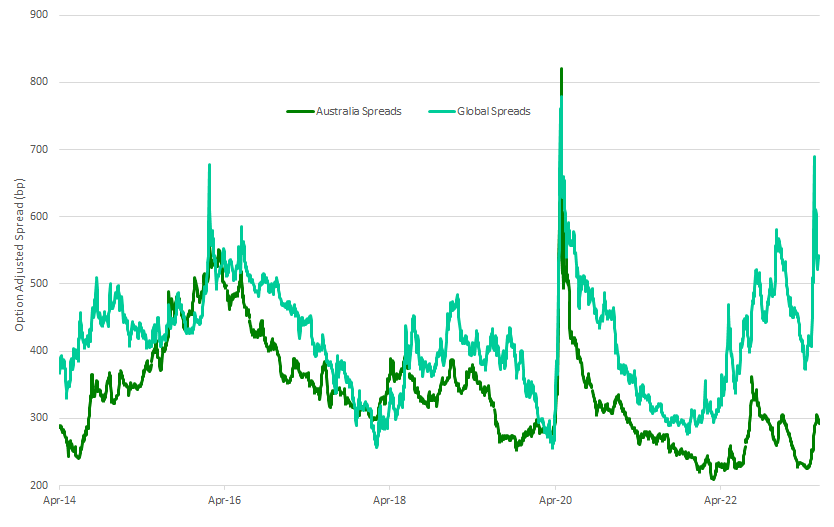

Offshore securities regularly offer higher spreads than similar local alternatives. The spread differential has averaged 0.73%p.a. since 2014, but at the end of 2022 the differential was particularly wide at more than 2%p.a.

Table 1 provides two current examples.

| Security | Next Call Date | Yield to Next Call | Spread to Swap | Price | Credit Rating |

| ASX: NABPF^ | Jun-26 | 6.1% | 2.4% | $104.90 | BBB- |

| ING 5.75% USD* | Nov-26 | 9.1% | 5.5% | US$88.24 | BBB- |

| ASX: WBCPJ^ | Mar-27 | 6.4% | 2.6% | $102.75 | BBB- |

| RABO 4.375% EUR* | Jun-27 | 8.1% | 4.8% | €85.67 | BBB |

Source: Bloomberg, ^Inclusive of franking, *Hedged to AUD except where stated. Data as at 20 April 2023.

In both cases, there is a clear return advantage offered by the offshore alternatives, when controlling for expected call dates and credit rating. Of course, with higher returns come a more diverse set of risks, but one reason that Dutch banks ING and Rabobank were chosen as comparators is their exemplary record of prompt coupon payments and strong risk management credentials.

Global spreads are more volatile but tend to converge toward Australian spreads over the course of a cycle, a phenomenon that an active investor can use to their advantage.

Figure 4: Hybrid spreads

Source: Bloomberg, Westpac. Data as at 10 April 2023.

The opportunity is now

As interest rates continue to normalise, investors once again have a real choice around how they generate income in their portfolio.

Hybrid securities have similar characteristics, but when you look at the correlation of returns between different regions over time the relationship is weak. Furthermore, offshore hybrid returns display a degree of cyclicality not evident in the Australian market.

An active investor will be drawn to data like this because combining these various sub-sectors will support risk-adjusted portfolio returns over time.

Disclaimer: Please note that these are the views of the author Brad Dunn, Senior Credit Analyst and Portfolio Manager at Daintree, and are not necessarily the views of Daintree. Some small changes were made to this article, based on updated information. This article does not take into account your investment objectives, particular needs or financial situation and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation.