The defensiveness of government bonds in Australia has been steadily declining for more than a decade. If a crisis develops, duration will still provide some defensive benefit. Yet, the diminishing defensive utility of duration should not be ignored, particularly in the context of prospective returns from other areas within the fixed income universe. High yields enhance income but also provide investors with a margin of safety against drawdowns. Funds focused on low duration, investment grade credit we believe are likely to perform well.

Fixed income portfolios were a source of volatility and drawdown for many investors over the course of 2022, in some cases underperforming equity allocations. After what were in some cases the worst returns seen from the asset class in decades, it is natural to ask how defensive fixed income will be going forward.

Is duration defensive?

What is defensiveness? We define a defensive investment as one that outperforms when growth asset returns are performing poorly. There will typically be a cost to this sort of defensiveness – when combined with growth assets into a portfolio, the overall return in periods where growth assets are performing well will be lower.

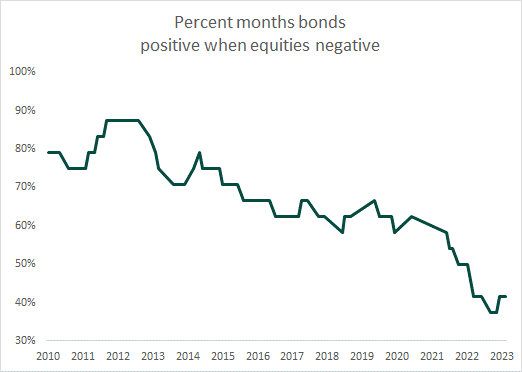

The fixed income asset class is incredibly varied, but the basic building blocks of the asset class are cash as well as risk premia related to credit risk, interest rate risk and illiquidity risk. Investors wanting a fixed income allocation focused on defensiveness have tended to hold less of their risk allocation in credit risk or illiquidity risk, and more in interest rate risk. Figure 1 shows why – while interest rate risk (duration) has added defensiveness to an Australian equity portfolio, its utility has been declining over time.

Figure 1: The defensiveness of government bonds in Australia has been steadily declining for more than a decade. This chart shows the proportion of negative ASX 200 months where the Bloomberg Composite Bond Index also showed a positive return. The series is shown on a rolling 24-month basis.

Source: Bloomberg, Daintree

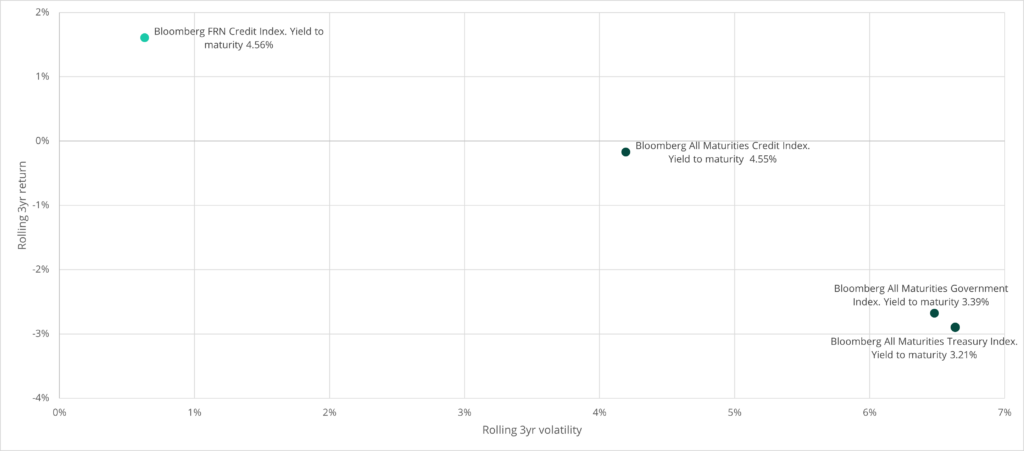

Does this mean that portfolios should not hold duration? Not necessarily. If a crisis develops, duration will still provide some defensive benefit. Yet the diminishing defensive utility of duration should not be ignored, particularly in the context of prospective returns from other areas within the fixed income universe. Figure 2 shows the returns of the main fixed income indices over the last 3 years plotted against realised volatility. The data points are colour-coded – those that are more reliant on interest rate risk (i.e. long duration) to generate returns are shown in dark green, as distinct from the aqua-coloured exposure where most of the return is generated by a combination of cash plus a credit spread (i.e. short duration). Yield to maturity statistics are also given as a measure of prospective returns.

Figure 2: Indices risk/return. Yield to maturity data as at 5 May 2023.

Source: Bloomberg, Daintree

The historical return differential over this period is clear: interest rate-related products have underperformed. The volatility of these products has been much higher as well. With no prospective medium-term return advantage (notice the yield to maturity is highest for the FRN Credit Index), an allocation to duration would make sense only:

- On the basis of short-term return expectations: Investors may believe that interest rates will decline such that duration allocations outperform. At Daintree, we believe short-term return forecasts can be problematic – a view backed up by a considerable research literature. We limit our exposure to short-term views that may or may not play out.

- On the basis that volatility in credit and duration-related exposures will converge: While this is possible, funds focused on low duration, investment grade credit are likely to perform well even in an adverse volatility scenario given the margin of safety provided by higher yields.[1]

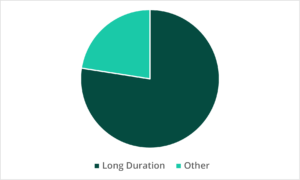

Another reason to reconsider duration exposures is that the level of duration risk held by many investors may be too high to begin with. Figure 3 analyses the Morningstar universe of Australian bond funds as at the end of April 2023, showing that almost 80% of assets under management in fixed income (excluding cash and fixed interest hedge fund strategies), are in funds where most of the return is sourced from a longer duration stance.

Figure 3: The Australian market is overexposed to duration

Source: Morningstar, Daintree: April 2023

An allocation to low duration, high quality investment grade credit has provided, and is still likely to provide, a better risk-adjusted return than government bonds over the medium-term. While government bonds have been an effective defensive asset historically, this effectiveness has been declining. Investors should consider this in the context of their asset allocation in the fixed income asset class. Funds such as the Daintree Core Income Trust offer investors exposure to a diversified pool of quality investment grade credit securities, offering yields that are historically elevated. High yields enhance income but also provide investors with a margin of safety against drawdowns. Against this backdrop, Daintree have been increasing low duration investment grade credit exposure across our funds.

If a crisis develops, duration will still provide some defensive benefit. Yet the diminishing defensive utility of duration should not be ignored, particularly in the context of prospective returns from other areas within the fixed income universe.

[1] We illustrate the ‘margin of safety’ concept further in a separate article “The case for liquid credit: Margin of safety”.

Disclaimer: Please note that these are the views of the author Justin Tyler, Director, Portfolio Manager – Interest Rates & Currency at Daintree, and are not necessarily the views of Daintree. Some small changes were made to this article, based on updated information. This article does not take into account your investment objectives, particular needs or financial situation and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation.

This article is provided for information purposes only. Accordingly, reliance should not be placed on this information as the basis for making an investment, financial or other decision. This information does not take into account your investment objectives, particular needs or financial situation and is not intended to constitute advertising or advice of any kind and you should not construe the contents of this email as legal, tax, investment or other advice. While every effort has been made to ensure the information is accurate; its accuracy, reliability or completeness is not guaranteed. Past performance is not a reliable indicator of future performance. The current relevant target market determination, product disclosure statement, additional information booklet and application forms for the Trust can be found on our website www.daintreecapital.com.au.