With a high margin of safety yields on offer in liquid securities make the current environment a compelling one for investors. Increases in both benchmark yields and credit spreads give confidence that the potential for drawdowns is now much lower.

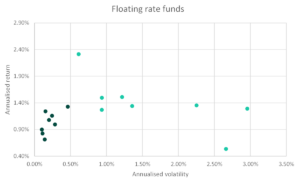

Fixed income portfolios were a source of volatility and drawdown for many investors over the course of 2021/2, in some cases underperforming equity allocations. Floating rate funds were shielded from this volatility for the most part, but within the floating rate universe there were funds that demonstrated a notably low level of volatility during the period as shown in Figure 1. The funds in the lighter colour include the Daintree Core Income Trust and similar peer funds.

Figure 1: Monthly returns and volatility over the past 24 months

Source: Morningstar as at April 2023

What explains the markedly different volatility profile illustrated by the darker colour data points? Persistent positive returns in a volatile environment may be a sign of manager skill, however this return profile is more likely achieved via investments where valuations are not marked to market, suppressing volatility. Some of the funds in the low volatility category of Figure 1 are mortgage funds, while others hold assets such as private loans. What these funds have in common is less frequent mark-to-market valuations, which indicate a lack of trading activity and liquidity. As a result, some of these funds offer investors liquidity on a less frequent basis (e.g., monthly rather than daily).

There is nothing inherently ‘wrong’ with such products. The point we are making is that low volatility should not be confused with low risk. In good times, a lack of liquidity can appear to be a positive feature that encourages more exposure to an investment because volatility is lower, as opposed to a risk that investors should be accounting for that may justify a smaller portfolio allocation. In stressed market conditions, the ability of investors to access their investment when required may be limited, as illiquid assets tend to become even more illiquid just as investors want to exit.

The good news for investors wanting the convenience of daily access to their investments is that yields on offer in liquid securities make the current environment a compelling one for investors wishing to reduce exposure to illiquid assets. What we have in liquid fixed income now that has been absent for some time is a high margin of safety. Increases in both benchmark yields and credit spreads give confidence that the potential for drawdowns is now much lower.

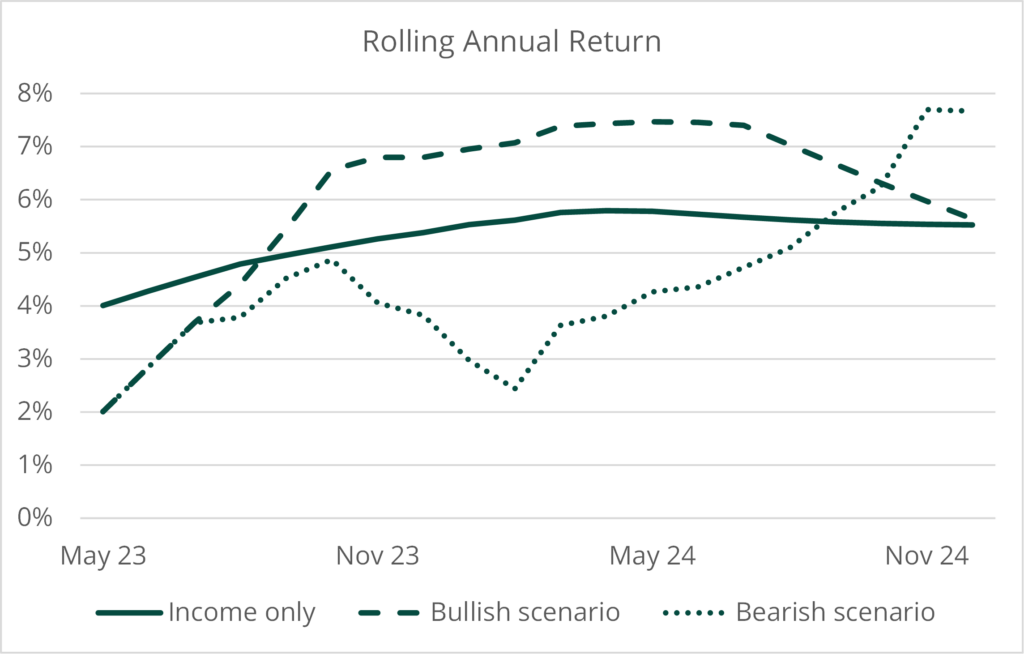

To illustrate the margin of safety concept, Figure 2 shows the expected return of the Daintree Core Income Trust in three scenarios:

- An ‘income only’ scenario where credit spreads remain at current levels. Rolling annual income is simply based on the evolution of current interest rates per market forward curves.

- A ‘bullish’ scenario where credit spreads revert from current elevated levels to a level around the historical average by the end of the year.

- A ‘bearish’ scenario where credit spreads rise another 100bp over the coming months, peaking in early 2024 and falling gradually thereafter.

Figure 2: Rolling annual forward expected return of the Daintree Core Income Trust in different scenarios

Source: Daintree. The above figures are forecasts only. While due care has been used in the preparation of forecast information, actual outcomes may vary in a materially positive or negative manner. Forecasts are subject to uncertainty and other factors outside of Daintree’s control.

Even in the bearish scenario in Figure 2 above, the rolling annual return remains positive. The maximum drawdown of 24bp in this bearish scenario occurs over a 2-month period. By contrast, widening credit spreads in calendar year 2022 meant the floating-rate credit universe saw many larger drawdowns that also lasted longer.

Of course, past performance is not an indicator of future performance. Higher income payments make bond allocations much more attractive and much more relevant to a wide range of potential investors. Importantly, the yields on offer in liquid investment-grade credit are now competitive with those from some private debt strategies. In fact, as credit spreads narrow, expected returns of around 7% from very defensive assets are competitive with long-term expected returns from growth assets as well.

Higher expected returns and an increased margin of safety have vastly improved the characteristics of floating-rate, liquid credit strategies like the Daintree Core Income Trust. As a result, we believe that there is now less incentive for investors to suppress portfolio volatility via illiquidity, because the margin of safety in liquid investment grade credit makes these assets compelling. We would also note that assets and funds that are not marked to market are likely being held at an inflated valuation given the correction seen in 2022. However, assets and funds that have been properly marked to market are now traded at considerably higher forward expected returns which makes the investment case that much more compelling. Even if credit spreads widen, drawdowns are a distant prospect given the margin of safety now available. Against this backdrop, Daintree have been increasing low duration credit exposure across our funds.

Disclaimer: Please note that these are the views of the author Justin Tyler, Director, Portfolio Manager – Interest Rates & Currency at Daintree, and are not necessarily the views of Daintree. Some small changes were made to this article, based on updated information. This article does not take into account your investment objectives, particular needs or financial situation and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation.

This article is provided for information purposes only. Accordingly, reliance should not be placed on this information as the basis for making an investment, financial or other decision. This information does not take into account your investment objectives, particular needs or financial situation and is not intended to constitute advertising or advice of any kind and you should not construe the contents of this email as legal, tax, investment or other advice. While every effort has been made to ensure the information is accurate; its accuracy, reliability or completeness is not guaranteed. Past performance is not a reliable indicator of future performance. The current relevant target market determination, product disclosure statement, additional information booklet and application forms for the Trust can be found on our website www.daintreecapital.com.au.