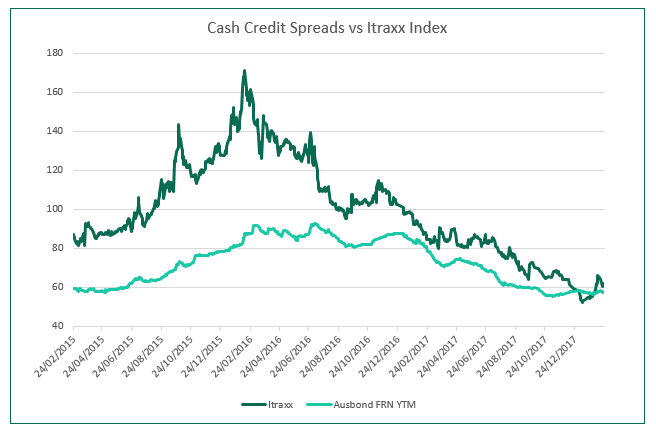

While the trends are the same, there have been some notable differences in the performance between Australian cash bond credit spreads and the credit derivative index, Itraxx, in recent times. Itraxx has materially outperformed cash spreads over the last two years, but has also shown considerably higher volatility. You can see this in the below chart. The volatility in the Itraxx has been particularly notable over the last month with the moves seen in other risk assets (e.g. shares). However, Australian cash credit spreads have largely avoided the carnage.

It’s not always fair to assume that the credit derivative index behaviour is representative of cash credit performance.

Source: Daintree Capital

These are the views of Mark Mitchell, Portfolio Manager.