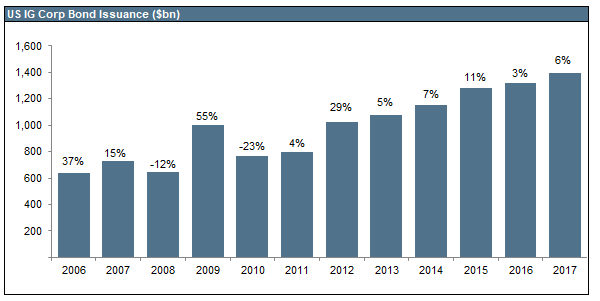

Australia’s corporate bond market is relatively underdeveloped compared to the US corporate bond market. In 2017, the US investment grade corporate bond market issued US$1.4 trillion compared to a record AU$75 billion of investment-grade issuance in Australia of which 75% was from financials. The index representing the Australian investment grade corporate bond market has approximately 385 issues with maturities to typically under 10 years whilst the US has more than 7500 issues with 29% of maturities over 10 years. The low number of Australian issuers is partly due to the high level of competitiveness of the Australian banking sector where loans are generally more flexible. The other contributor is tenor, with bank loans issuing up to 3 years (recently even up to 5 years), whereas the Australian bond market has typically been a 3 to 7 year tenor market, only recently issuing 10 years maturities within more stable sectors such as the regulated utilities. Australian corporates often go to offshore markets to issue in tenors longer than 10 years or where they have operations which require USD financing.

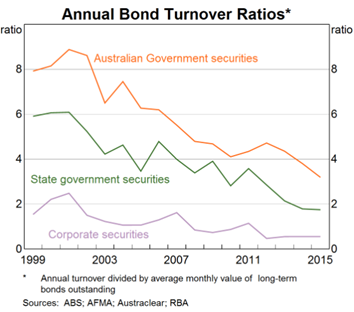

Australian corporate bonds have predominantly been a buy and hold market. The chart below shows the annual bond turnover ratios for Australian bond securities with corporate bonds having been below 1 for the last few years. The lack of corporate supply means that buyers have typically been scaled due to books typically being oversubscribed and deals pricing at the low end of guidance or even tighter. This highlights the need to be able to access offshore credit markets to diversify risks and access opportunities not present in the Australian market.

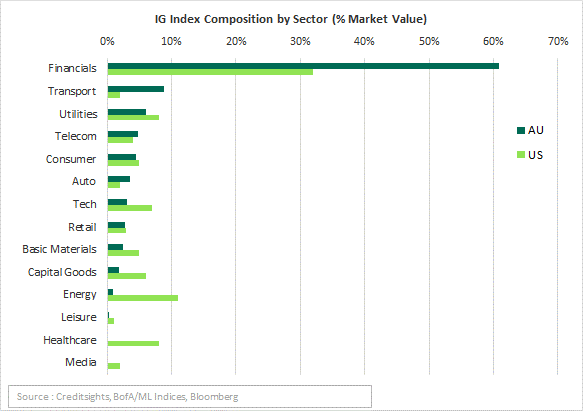

Sector Allocation

The US corporate bond market is rich with diverse issuers in industries and sectors not present in the Australian corporate market.

The Australian bond market is predominantly investment grade rated with 75% of issuance from financials, this is shown in the index composition with 60% in financials followed by less than 10% in each of the other sectors. Comparing this to the US IG index composition which has 30% in financials and 10%-20% in every other sector apart from Basic Materials.

Having access to issuers from the US market allows diversity of the bond portfolio to companies with high barriers to entry and pricing power that are not present in the Australia bond market. This can lower concentration risk of portfolios to the main sectors of AREITs and Utilities in Australia.

Valuation

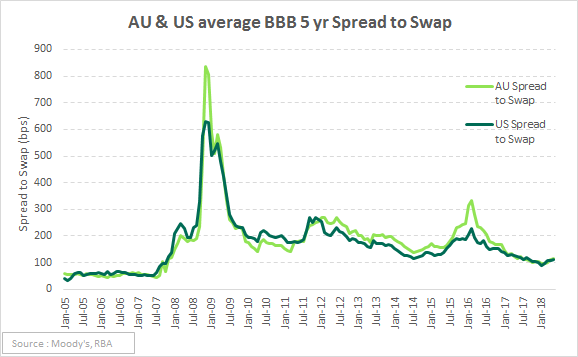

The chart below shows the average BBB rated corporate 5 year spread to swap levels for Australian and US corporate bonds. The overall trend and movement of both Australian and US spreads move in line with each other over time, however, AU spreads seem to be more volatile, particularly during extreme periods such as the GFC in 2008-2009 and the Euro crisis in 2012.

The recent tightening policy stance by the US takes away from some of the spread pickup from the swap of US spreads to AU spreads but there are still pockets of value to be found.

Risk

Investing in the US corporate bond market is considered riskier than Australia with the recent trend of cheap financing funding share buybacks and dividends pushing credit metrics to their limits. BBB rated issuers now represent almost 50% of the corporate investment-grade index in the United States, while in Australia, it is 21% of the credit index. This highlights the need for bottom-up research and due diligence on the fundamentals of individual issuers to find value.

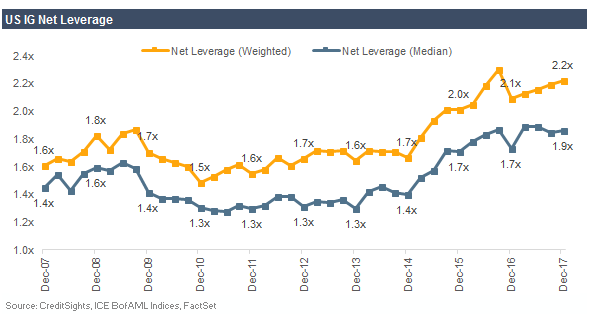

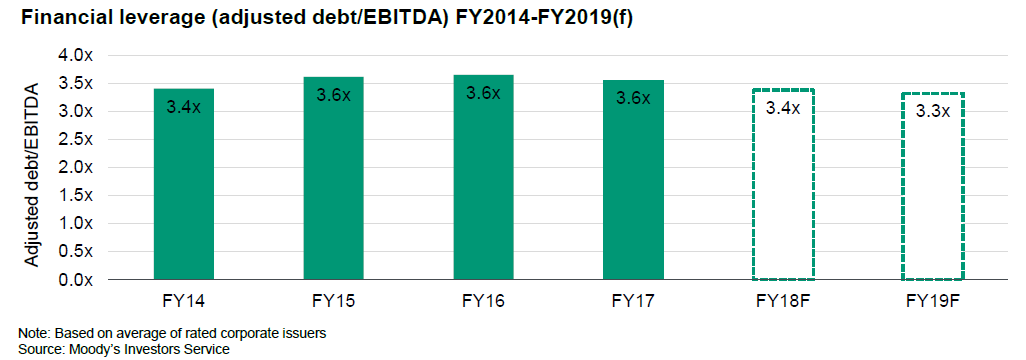

The chart below shows that US investment grade net leverage has been increasing in the last few years partially due to the access of cheaper financing with interest rates at historical lows which are being used to fund dividends or buybacks. In contrast, Moody’s note that the adjusted financial leverage of its Australian rated corporate issuers has remained relatively stable during a similar time period of cheap financing and is expected to decrease over the next 2 years.

Conclusion

The US corporate bond market is a good diversifier for risk and provides greater opportunities to exploit mispricing and relative value compared to a portfolio of only Australian corporate bonds. The small number of issuers with concentration in the Financials, AREIT and Utility sectors in the Australian market, along with the scaling means most Australian managers are exposed to similar issuers. US investment grade corporates present higher credit risk and are more volatile in spread, and this reinforces the need for due diligence on issuers to find value between fundamentals and pricing. We highlight relative value between domestic and offshore markets with an example in a prior article where we looked at a new US domiciled issuer in the AUD market where there was more value in acquiring the existing USD issue.

Daintree Capital is an unconstrained absolute return manager. By being able to look offshore, we are able to diversify our holdings away from Australia to lower risk and preserve capital, and we are also able to look for opportunities offshore to generate a higher return and take advantage of mispricings and relative value.

Disclaimer: This is the viewer of the author and not technically the views of Daintree