Incorporating Environmental, Social and Governance (ESG) analysis into fixed income has progressed by leaps and bounds in recent years. While a thorough analysis of each of the key ESG themes takes place as part of a company review, at Daintree we are taking this a step further by seeking to determine the materiality of those factors.

Materiality can be defined as the likelihood that a particular factor will influence the performance of a business, which could in turn have an impact on its earnings, the environment, the community or its reputation.

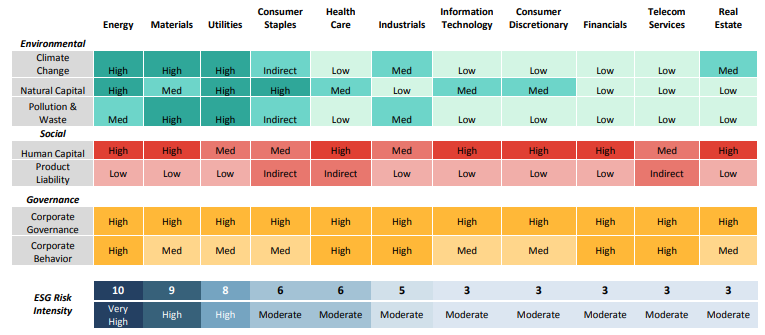

Materiality is ultimately subjective, but research groups such as MSCI have made solid progress on estimating materiality at the sector level (see Figure 1). Some of the risk assessments are self-evident, such as the materiality of climate change, pollution and the like for the mining, energy and utilities sectors compared to other sectors such as health care.

Figure 1: MSCI ESG Risk Intensity

Source: MSCI

With the focus channelled on those areas where materiality is high, it is more likely that any significant red flags emanating from these themes will impact performance over time. Therefore, using a materiality approach we hope to identify potential risks sooner and avoid companies that do not demonstrate a commitment to improving ESG outcomes where we assess the risk intensity to be material.

The ESG thematic in fixed income continues to evolve at a rapid pace. We believe that using a materiality approach has improved the quality and efficiency of Daintree’s ESG process and allowed us to stay at the forefront of developments.

This is the opinion of the author, Brad Dunn, Senior Credit Analyst and Daintree’s ESG specialist.