Investors who are new to the bond market are often a little confused by the relationship between bond yields and bond prices.

The yield on a bond has gone from 4% to 3%. Is that a good or bad thing? The answer is it depends. If you already own the bond it’s a great thing because you have realized some positive performance. However, if you were thinking about buying this bond the expected return of the bond is now lower given the rally in price already witnessed. Unlike stocks which theoretically have no limit as to how far they can rally, bonds are a contractual obligation to pay a fixed amount, so they will tend not to move too far away from the value of those agreed payments.

Bonds are generally issued at par or a price of $100. The value of a bond is estimated based on the present value of all expected future cash flows. If the price of a bond is par, then the expected return to maturity is roughly equivalent to its coupon. However, if the price of a bond is trading above par then the expected future return will be less than the coupon. If you buy a bond at $101, but only get $100 back at maturity, then the extra $1 paid at the time of purchase will detract from the overall return.

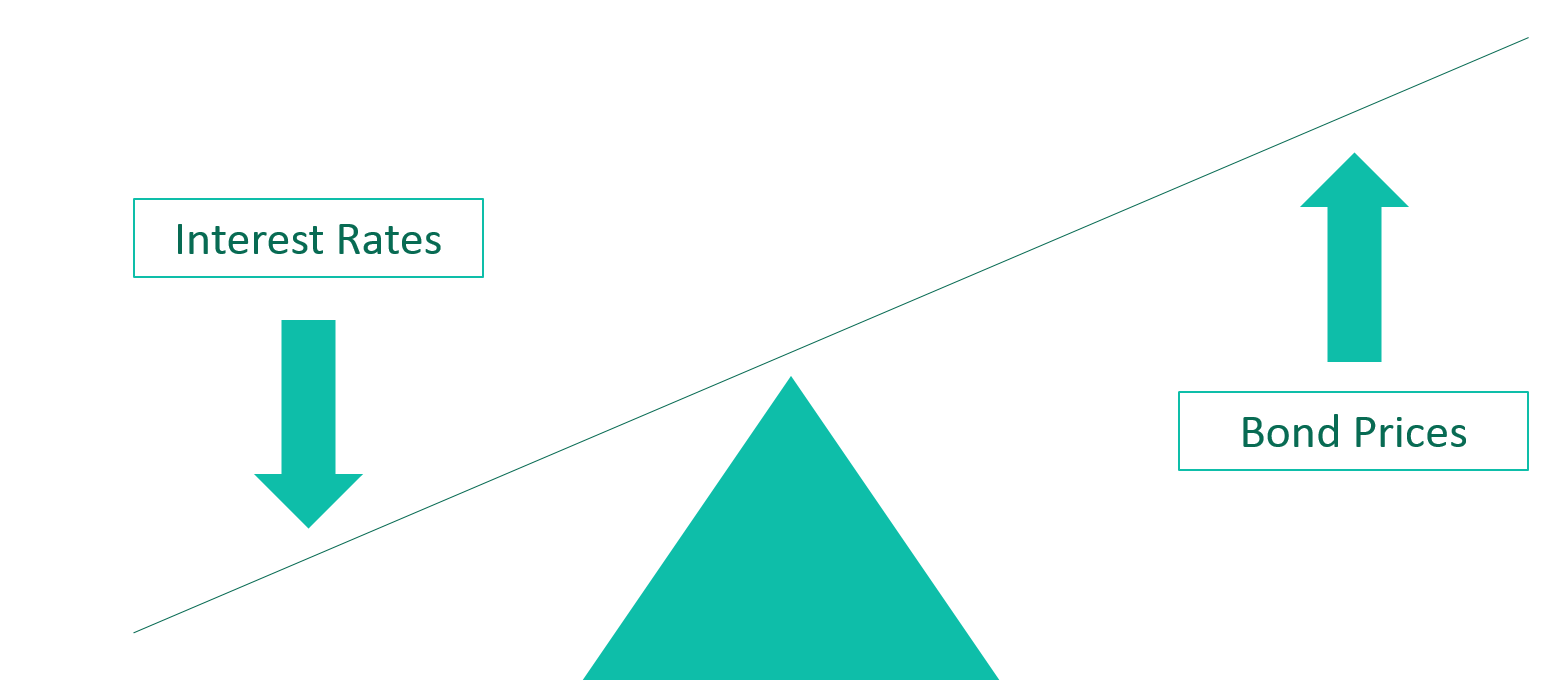

Let’s say a company issues a bond with a 4% coupon and a 10-year maturity. A year later the prevailing fair value for a similar 9-year bond is 3%. Because the bond issued a year ago has a higher expected cash flow stream than newly issued bonds, the price of that bond will have traded up to reflect its higher relative value compared to similar bonds. The price of the bond will have increased roughly to the point where its expected 9-year annual return will have dropped to 3% in-line with fair market value. It’s these changes in secondary market prices that allow bonds with different maturities and coupons to be compared and efficiently priced in the secondary market. This is why there is an inverse relationship for fixed rate bonds between interest rates and the price of previously issued bonds as demonstrated below.

The potential negative change in the value of a bonds caused by the change in prevailing interest rates is called mark to market risk. This is a risk that must be considered and managed when purchasing an individual bond or constructing a bond portfolio.

This is the view of the author, Mark Mitchell, Director & Portfolio Manager. The information contained within is generic in nature and does not take into account your personal circumstances.

To find out more on the funds Mark and the team manage, visit Daintree Core Income Trust and Daintree High Income Trust. Please see our terms of use page for terms & conditions.