Lessons for Fixed Income Investors – on the 10 year anniversary of the GFC

This September 2018 marked the 10 year anniversary of the collapse of Lehman Brothers which was regarded as the focal point of the Global Financial Crisis (GFC). Lehman Brothers, which had survived the Great Depression, World Wars, Long Term Capital Management and the Russian debt default, could not deal with the high degree of leverage and large portfolio of subprime mortgage securities on its balance sheet and went bankrupt. We share a few of our key lessons from the near collapse of the global financial system from a fixed income perspective.

Liquidity

Cash is king. In the lead up to the GFC, years of easy credit conditions from the aftermath of the dot-com bubble and September 11 attack drove returns to very tight levels causing investors to search for yield in deep corners of the market. This led to funds offering higher returns through higher yielding but more illiquid securities, causing a mismatch between the liquidity of the securities in funds and the liquidity offered to investors in the fund. Once the crisis became widespread, investors trying to pull their money out of funds were either forced to take a steep haircut or were ‘gated’ out of pulling their funds entirely. When the outflows are faster than the underlying investments can be sold, or if the buy/sell spread isn’t a fair estimate of the cost of trading, investors that stay will suffer losses that should have been attributed to those who left early, causing a mass rush for the exits.

Cash is king.

The latest trade of a security creates a dangerous illusion that its market price approximates its true value. This mirage is especially dangerous during periods of market exuberance. There was also the concept of “mark-to-model” as an anchor to the proper valuation of a business can also be greatly skewed during ebullient times and should always be considered with a healthy degree of scepticism.

Having a proper understanding of the liquidity of the assets in the portfolio partially alleviates the problem. Regular assessment and stress testing of the liquidity of different assets in the portfolio will indicate how liquid and how long the portfolio would take to be sold to return cash to investors. During times of stress liquidity can evaporate quickly. It’s essential to carefully consider the underlying liquidity of assets held in any investment product. Higher returns often come at the expense of imbedded illiquidity risk

Scheduled Call Dates

Deutsche Bank became the first major European bank to not redeem a subordinated bond at the first scheduled call date, due to mature in January 2014 but with a call date in January 2009, because the cost of doing so would be higher than paying a penalty of 88 basis points over Euribor for not redeeming the debt. This angered investors and caused a loss of trust in the scheduled call dates in securities, effectively repricing the subordinated cash bond market down approximately 10bps and also impacted the European iTraxx subordinated bond index, with investor expectations that other bank subordinated bonds would no longer be called at their first scheduled date.

Assessing the value of securities with call dates should not be limited to the generic pricing to call, as is typical during times of low volatility and high liquidity. During times of market stress, securities with long periods between final maturity and first call date should be assessed with the possibility that they may not be called during the call date, leading to a large drop in value from being priced to maturity.

The Dangers of Complex Products

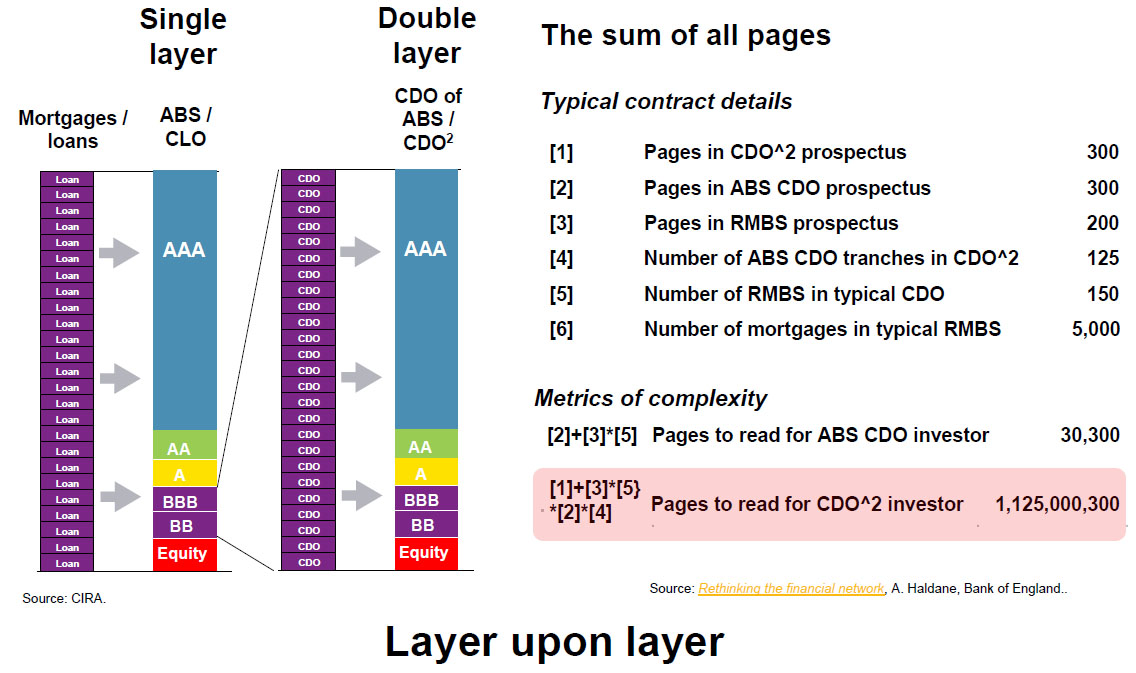

Some of the largest losses during the GFC came from products that relied heavily on financial structuring of junk type assets into AAA investments that very few people really understood. In the lead up to the GFC, banks found themselves oversupplied with sub-prime mortgages, packaged them up with other debt to on-sell as complex investment products (‘collateralised debt obligations, CDOs’). Often these carried high ratings from the big three rating agencies (Moody’s, S&P and Fitch) which portrayed a sense of security. As the search for yield continued, more complex securities came to the market. Securities such as ‘synthetic CDO’ were cheaper and easier to create than original cash CDOs and were in effect providing insurance against mortgage defaults referencing cash CDOs, multiplying the effect when the security defaulted. The next product suite came in the form of CDO squared and CDO cubed, which were CDOs where the underlying portfolio included tranches of other CDOs. As the crisis unwound, so too did the layers of leverage, revealing the complicated multiple layers of look-through of the underlying subprime mortgages. Warren Buffett once said, “If you take one of the lower tranches of the CDO and take 50 of those and create a CDO squared, you’re now up to 750,000 pages to read to understand one security. I mean, it can’t be done. When you start buying tranches of other instruments, nobody knows what the hell they’re doing.” (see graphic)

When excesses such as lax lending standards become widespread and persist for some time, people are lulled into a false sense of security. These excesses eventually end and the historical data of low volatility becomes surprisingly high when the leverage rapidly unwinds. The rating agencies typically follow the market and have been slow to detect frequent near-defaults, defaults and financial disasters, as well as failure to downgrade troubled firms until just before/after the declaration of bankruptcy. During the global financial crisis, hundreds of billions of dollars’ worth of triple-A-rated mortgage-backed securities were abruptly downgraded from triple-A to “junk” within two years of the issue of the original rating. Moody’s admitted that they didn’t have a good model on which to estimate correlations between mortgage-backed securities (MBS).

The lesson here is to not invest in anything you don’t understand and don’t rely on third party institutions (such as the rating agencies) to do your thinking for you.

The search for yield is enticing during periods of exuberance and new and untested financial products are typically created during this period. These new products typically have little data and a short time series to undergo rigorous testing through market cycles.

Financial Modelling

Financial models are meant to be a representation of a firm or security. Too often people assume models accurately reflect reality when in fact they are at best an approximation. Models require assumptions that are typically representative of the period they are in and during times of stress, the assumptions are insufficient or not representative of the new reality.

For structured products, it is necessary to model the cash flows and the loss distribution generated by the asset portfolio over the life of the CDO, implying that it is necessary to model prepayments and default dependence (correlation) among the assets in the CDO and to estimate the parameters describing the dependence. This requires assumptions about the stochastic processes that describe the evolution of the different factors, such as interest rates and prepayment behaviour, and the estimation of the parameters describing these processes, which usually requires the use of time series data.

To test model predictions against actual outcomes requires data. Unfortunately, for many types of collateralized products, data availability is limited across instruments and did not extend over long periods. Consequently, there was little information about the accuracy and robustness of models over different parts of the credit cycle. To assess the credit risk of structures, it is necessary to consider other risk dimensions, such as market liquidity and valuation of collateral. These factors were overlooked, though they affect the credit worthiness.

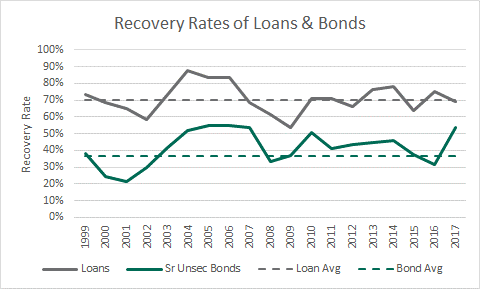

An example of this were the recovery assumptions used to model loans in structured products. Loans have a historical average recovery of 70% but during times of market stress, these recoveries drop below the average, meaning the pricing from the model outputs are incorrect.

Source: Moody’s, Daintree Capital

During the crisis, the subprime correlation all converged towards one, despite the different FICO scores, demographic and geographic diversity of the underlying collateral. This broad brush also extended to similar assets where we saw Australian mortgage-backed securities were not as risky as their US counterparts with relatively few subprime loans and asset-backing levels were much higher, yet were marked down similarly in line with US mortgage securities.

The lesson here is to be careful about over-reliance on models. They can be useful but are never perfect and can lead to overconfidence in your conclusions.

Leverage

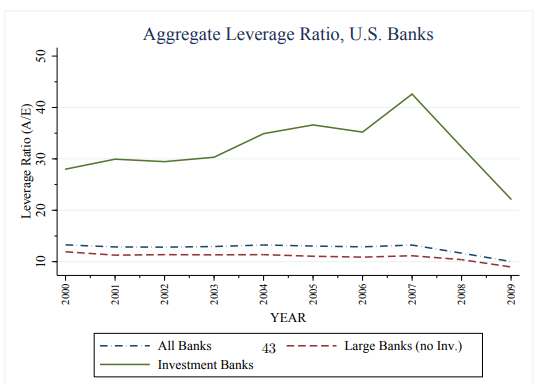

In the lead up to the GFC, the market underappreciated the impact of leverage, which amplified capital market volatility. Banks and other investors in the United States and abroad borrowed increasing amounts to expand their lending and purchase MBS products. Using leverage to purchase an asset magnifies potential profits but also magnifies potential losses. As a result, when house prices began to fall, banks and investors incurred large losses because they had borrowed so much. Additionally, banks and some investors increasingly borrowed money for very short periods, including overnight, to purchase assets that could not be sold quickly. Consequently, they became increasingly reliant on lenders, which included other banks, extending new loans as existing short-term loans were repaid. By 2008, Lehman had assets of $680 billion supported by only $22.5 billion of capital. With leverage of 30x, a small decline in the order of 3% to 5% in asset values would be enough to wipe out the capital. The government sponsored mortgage entities Freddie Mac and Fannie Mae were using leverage closer to 100 to 1 due to their stricter lending standards and implicit government backing but still eventually had to be bailed out by the US government.

Source: NBER

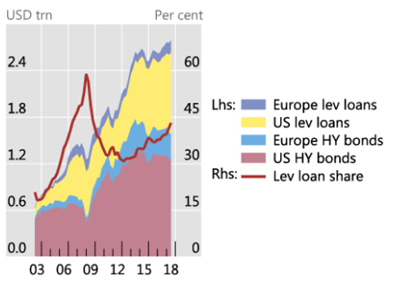

Investor demand is an important driver of the recent growth in leveraged loans. During exuberant times, investors have continued willingness to accept weaker protection against deterioration in borrowers’ repayment capacity in the form of covenant light (cov-lite) loans. Investors are not necessarily being compensated for this risk can be seen in the behaviour of price flexes: adjustments to new-issue spreads that a loan arranger makes in order to clear the primary market. The ratio of down- to up-flexes has risen markedly in recent years, with borrowers benefiting from lower loan spreads. In addition, strong investor demand for leveraged loans has supported refinancing.

Source: Bank of International Settlements

In a market cycle, leverage starts to increase after the bust before it peaks again near the top. During market crisis, when combined with tighter margins and complex products, small losses become amplified due to the large leverage inherent in the system. It is also not safe to assume a maturing loan can be rolled over and even if they could, the refinancing cost are usually a lot higher.

The lesson here is to be mindful of leverage in all its forms.

Importance of True Diversification

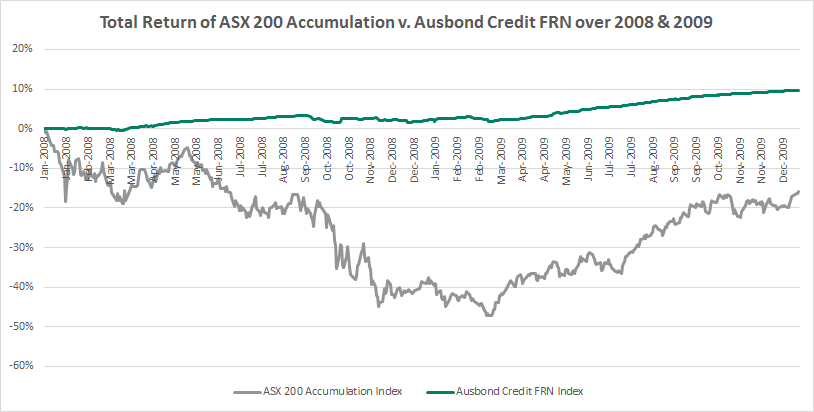

While listed property trusts and hedge funds were popular alternatives to low-yielding government bonds prior to the GFC, through the crisis they were underperformers, whereas government bonds and high quality fixed income outperformed. The chart below shows the total return of the Bloomberg Ausbond FRN Index against the ASX 200 Accumulation Index over the two years of the crisis. It shows how fixed income outperformed the equity market during times of extreme stress. The GFC reminded us the importance of asset allocation in a portfolio, during a crisis the manager and stock selection can be of second order importance.

This recurrence has shown with recent examples including the sovereign debt crisis in Europe, the taper tantrum (when Treasury yields surged anew after the Fed announced it would begin scaling back its bond-purchase program), Brexit and the U.S. presidential election in 2016 also moving markets. In each case, the first line of defence has been an allocation to fixed income.

When market conditions are at extreme tight levels, the need to protect returns requires a need to be hedge portfolios. Fixed income can be a source of hedge and diversification, while currently not yielding equity like returns, is a necessary allocation during specific time periods when you have drawdowns in the higher risk spectrum and require a less correlated asset class.

Conservative positioning entering a crisis is crucial, it helps investors maintain a long-term orientation think clearly, and to focus on new opportunities while others are distracted or even forced to sell.

Portfolio hedges must be in place before a crisis hits. Investors cannot reliably or affordably increase or enact hedges while a crisis is occurring.

Source: Bloomberg, Daintree Capital

During the worse periods of the GFC, fixed interest and cash outperformed all other asset classes. With equity markets at historically overstretched valuation metrics, a decade into a bull market and the continual underweight towards fixed income, we question whether portfolios in Australia are diversified enough if we see a major market correction.

At Daintree Capital, we are a global unconstrained fixed income manager, able to position ourselves on either side of a rising or falling markets. We are not benchmark constrained, meaning we can sit back and not be forced to remain invested to match benchmark returns. Having lived through the GFC, we have worked hard to incorporate all these lessons learned into our investment processes. That doesn’t mean it will always be smooth sailing through the next financial storm, but we’ve done what we can to reduce the risk of the ship taking on water and sinking.

The author, Simon Wang, is a Senior Credit Analyst at Daintree Capital. Click on the links find out more about Daintree Capital’s Core Income fund and High Income fund.

Disclaimer: This promotional article is provided for information purposes only. Accordingly, reliance should not be placed on this promotional article as the basis for making an investment, financial or other decision. This promotional article does not take into account your investment objectives, particular needs or financial situation. While every effort has been made to ensure the information in this promotional article is accurate; its accuracy, reliability or completeness is not guaranteed. Past performance is not a reliable indicator of future performance.