Key Points:

- Data suggests active investment grade fixed income managers generally outperform passive strategies

- Changes to underlying index composition is a key driver of active management outperformance

- Indexes composition changes over time which may lead to unwanted risks with passive strategies

- Passive strategies make even less sense in an environment of rising interest rates

- While active management makes sense not all active management is created equal. Make sure you are getting value for the service.

- Passive strategies might make sense for simple low-cost index replication for people who are less concerned about volatility and performance

Given the recent passing of Jack Bogle, who is largely considered to be the father of passive investing, we felt it might be a reasonable time to look at passive versus active investing in fixed income.

We do share the view that passive investors largely get a free ride on the backs of active managers who look to determine the fair value of financial assets which should improve the likelihood that capital is efficiently allocated. But that’s another discussion. What we would like to do in this article is look at passive versus active management in fixed income purely on its merits from an investor’s perspective.

Below is a basic summary of the merits of passive fixed income investing:

| Pros | Cons |

| Lower Fees | Data supports idea active managers consistently outperform after fees generally with lower volatility |

| Ease of use | Follow arbitrarily constructed indices and can be poorly diversified |

| Perceived higher liquidity | Can lead to undesirable changes to the portfolio as the underlying index composition changes (industry, duration, single issuer) |

| Herding mentality can lead to higher volatility | |

| Often do not look for offshore assets |

Let’s start with passive investing. There has been significant growth in demand for passive fixed income strategies. We see four likely drivers of this trend: The first and most obvious one being lower fees. On average passive strategies do tend to have lower fees than active ones. Who would this not appeal to? Who wouldn’t want to get something at a cheaper price? But of course, you have to make the distinction between price and value.

A second feature of passive strategies that appeals is their ease of use. These types of funds allow individual investors to get easy access to a much more diversified portfolio than would otherwise be practically possible. Unless you have a relatively large pool of capital, it could be challenging to construct your own appropriately diversified fixed income portfolio.

Another idea that seems to appeal to passive fixed income investors is the perception of liquidity, especially for exchange traded funds (ETF) and exchange traded managed funds (ETMF). We largely agree with this idea, but investors do have to understand that market makers could step away in an extreme scenario and liquidity of the ETF will be impacted by the liquidity of the underlying assets. You have to be mindful of the underlying risks. In other words, not all liquidity is the same across ETFs and ETMFs.

One last point on the likely drivers of passive demand, it is our perception that part of the reason for the growth in passive fixed income investment is the assumption that what holds true for equities probably holds true for bonds. Unfortunately, the data does not support this idea (as we’ll discuss shortly). Anyone who invests a bit of time looking at the research would find it hard to draw the conclusion that economically they would be better off in a passive strategy; so the conclusions are either 1) they haven’t looked at the data or 2) they are less interested in economic outcomes and more focused on the other perceived benefits.

Turning to active investment management, below is a basic summary of the merits of active fixed income investing:

| Pros | Cons |

| Data supports idea active managers consistently outperform after fees generally with lower volatility | Higher Fees |

| Can move away from arbitrarily constructed indices. Ability to invest “off index” leads to a much broader investment universe | Some managers outperform the underlying index by just taking more risk |

| Ability to be precise about the risks taken | |

| Can take advantage of new issue discounts |

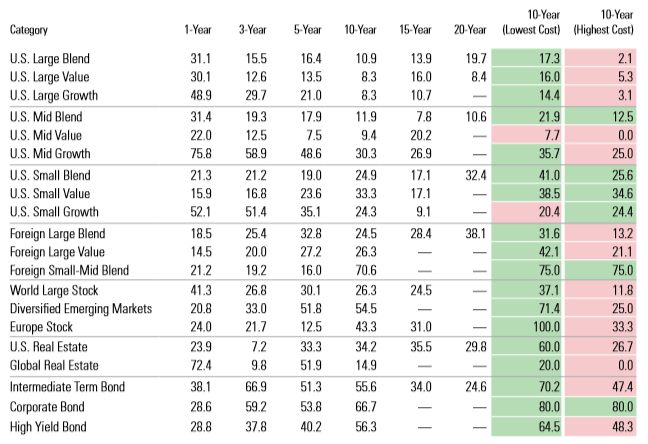

Let’s start with the most important idea: the data shows that active fixed income managers tend have a good track record of outperforming passive fixed income managers. The table below from Morningstar looks at the success rate percentage of funds in various categories. Essentially the percentage of active funds that outperform their passive counterparts:

Source: Morningstar’s Active/Passive Barometer February 2019. Data is as at 31/12/18

Looking at the Intermediate Term Bond and Corporate Bond categories over the last 10 years we can see that the majority of those funds outperformed their relevant passive peers. And looking at the low cost funds 70-80% outperformed over same period. Contrast this with funds in the US large capitalisation sector equities where only about 10-15% outperformed over the same period.

Why does this occur? It appears active US Large Cap managers seem to struggle to outperform comparative passive strategies after fees. Are the fixed income folks smarter and better at what they do than their equity counterparts? As a fixed income person it would be nice to think that, but unfortunately it’s not the case. In our estimation there are six key drivers:

- Bond Maturities: As the old joke goes, “What’s the difference between a bond and a bond trader? A bond eventually matures”. Funnily enough it’s the ongoing bond maturities and subsequent issuance of new bonds that help make active bond portfolio management a compelling argument. Most bonds are issued with a final maturity date which means new bonds have to be issued as those older bonds mature. Issuers usually sell those bonds at a discount (higher yield) in order to attract demand. Active managers tend to drive this process. Pure passive managers by contrast will often buy the new bonds only once they enter their relevant index at higher prices (lower yields) than where the active managers purchased them. This process is repeated many times a year and contributes to active manager outperformance. By some estimates, new issuance makes up about 20% of bond market capitalisation annually as compared to about 1% in equity markets. Its easy to see how this can contribute to outperformance over a pure passive strategy.

- Investible Universe: Another major driver of relative out-performance is a larger potential investment universe. There are many pockets of fixed income securities that simply do not appear in actively followed indices. By one estimate approximately two-thirds of the investable universe in the US is not covered by a major index. In Australia for instance, there is no widely recognised index for residential mortgage backed securities, despite the market being very large and widely followed by active fixed income managers. Any passive manager only following the major indices would miss out on the asset class entirely.

- More Credit Risk: Another reason we believe many active managers outperform is by taking more credit risk. As we’ve outlined previously (link), we are not a fan of fixed income indices. Indices are constructed with specific rules that only look at a portion of the universe. One common rule is a minimum credit rating of the securities that make it into the index. Active managers will frequently allow their portfolio to take more risk than the index through time by overweighting riskier securities. Assuming the issuers don’t default, higher risk/higher yielding securities are guaranteed to outperform lower risk/lower yielding securities given the contractual obligations to pay higher coupons. This is a simple way for active managers to systematically outperform an index over time. It also means when evaluating active managers investors should be very mindful of how much risk is embedded in their portfolios not just the absolute level of returns

- Targeted Risks: Another major driver of active outperformance is the ability to position for the market environment and target specific risks. As an example, the vast majority of bonds issued globally have a fixed coupon rate and therefore a long duration position. Which means those bonds will perform poorly as interest rates rise. Active managers can hedge or reduce this risk when it appears likely interest rates are set to rise. Given that many passive strategies follow indices with long duration, we would argue that active manager outperformance would have been even higher over the last 10 year if we had been in a rising rate environment. Another example is around credit ratings downgrades. The index rules around minimum credit rating, sometimes securities must exit an index when they are downgraded. Through fundamental credit research, active managers can usually make a good estimate as to when securities are at risk of a downgrade. They can then sell those bonds before a downgrade and before they fall out of the index and lock in outperformance. Passive managers would typically hold such securities until they exit the index, by which time a lot of negative performance would already have been incurred.

- Non-economic Buyers: There is a large pool of non-economic buyers in the fixed income markets, especially with respect to government bond markets. Non-economic buyers are not necessarily trying to maximise risk adjusted returns and are therefore much less price sensitive. Central banks may buy bonds to weaken their currency, boost inflation or stimulate growth. Insurance companies may be forced to buy bonds for asset-liability matching purposes, while banks may be forced to hold government bonds for liquidity and regulatory reasons. This activity by non-economic (less price sensitive) participants creates opportunities for active managers. By some estimates non-economic investors make up approximately 50% of the global bond market.

- Lower Fees: Active equity managers tend to charge a higher fee than active fixed income managers. This means they have to outperform by that much more to beat their passive peers. According to data from Morningstar, average active equity fund fees are about 18 basis points higher than average active bond fund fees.

There are other reasons why active outperforms passive such as active managers buying more illiquid assets, having the ability to look for offshore assets, and relative value analysis but we believe the ones above are the most significant drivers.

Beyond pure performance differences, when comparing the pros and cons of active and passive strategies, it would come as no surprise that many of the drawbacks of passive strategies are relative strengths of active strategies. We’d highlight three key differences:

- Passive strategies may lead to unintended exposures as the composition of the underlying index changes. Examples might include longer duration, greater single name and sector exposures or greater overall credit risk. Active strategies allow managers to customize desired exposures.

- Its commonly known in the investment management industry that fund flows tend to follow performance. Meaning that if a fund or asset class has been performing well more people will pile into it even though the price paid after a period of good performance may no longer be appropriate. This is the “chasing returns” concept. We believe this will occur even more frequently with price insensitive passive strategies and lead to increased volatility. This is particularly an issue in fixed income funds because buying at higher prices means locking in lower yields.

- Poor diversification. Fixed income management is a defensive game. Investors are rewarded for avoiding losers more so than picking winners. Any time a strategy has too much exposure to one sector or issuer, the risk increases that something can go wrong and severely damage returns. Be mindful of passive strategies that are not well diversified.

In Australia we’ve seen the launch of a number of passive fixed income strategies. While they do meet the criteria of being low cost and easy to use, our concern that many of them are arbitrarily constructed and poorly diversified. They appear to have a heavy exposure to Australian financial institutions and not much else. While we have a favourable view of this sector, we believe a more diversified portfolio approach will lead to better investment outcomes over time.

The rise of passive (or non-economic) strategies creates opportunities for active equity and fixed income managers. As an active fixed income manager, we welcome the dislocations and opportunities created by the growth of these strategies. However, we are loath to see uninformed investors pile in too aggressively as we don’t believe it will serve them well in the long run.

While passive management does seem to make sense in some equity markets, we do struggle to see a compelling argument for passive management in fixed income when better performing active strategies are so readily available, particularly in a low interest rate environment. However, we would caution that, in our opinion, not all active management fees are fully justified, but in the main we do believe it’s a better hunting ground for investors looking for value for their management fee dollars.

The marketing pitch for people selling passive fixed income strategies might be something like “Be Long and Carry On” but hopefully we’ve highlighted a few things investors might want to consider before buying a product just because it seems simple and cheap. For investors looking for a simple low-cost exposure to fixed income, these strategies might make some sense. However, if your priority is better investment outcomes with lower risk it might make less sense. We believe in the old saying that “you get what you pay for”, and that most certainly rings true when considering the question of active and passive management in fixed income.

Disclaimer: Please note that these are the views of the writer and not necessarily the views of Daintree Capital. This article does not take into account your investment objectives, particular needs or financial situation.